Comparing Top 225 International Design Firms revenue from 2020 to 2021 reveals a market at times paralyzed by project risks. As rising construction costs, COVID-19 impacts and a stop-and-go supply chain kept owners second-guessing timelines and investments, Top 225 firms used market data to help rescope projects to improve cost certainty. The result is marginal gains in a market still sick with pandemic shutdowns.

As a group, the Top 225 firms’ revenue increased by .8%, from $67.14 billion to $67.65 billion in 2021. Consequently, median firm revenue also marginally rose from $47.5 million to $47.83 million. The percentage of design firms reporting a profit was up markedly from 89.4% to 96.7%, with 20 more firms sharing that data than previously.

As of the close of the first quarter, Top 225 firms say their priorities and those of their clients have shifted—or in other cases, increased in urgency as the global climate crisis, market inflation and war instigated by Russia's leader with Ukraine have accelerated work in some sectors and disrupted work in others.

“All markets are still feeling the impact of the global COVID-19 pandemic,” says Alan Manuel, CEO, Currie & Brown, a Dar Group company. “Combined with the ongoing uncertainty stemming from the invasion of Ukraine, we are experiencing a growing insecurity among clients that affects the viability of projects and the way we work with them to identify and overcome risks to ensure delivery.”

More change in market sectors around the world stems from an abundance of big ticket federal infrastructure spending plans meant to bolster economic recovery from the pandemic and push countries toward a more climate resilient and sustainable future—such as the $1.2-trillion Infrastructure Investment and Jobs Act, China’s plan to spend $1.1 trillion to spur economic movement, Saudi Arabia’s Vision 2030 and Europe’s more than $800-billion NextGenerationEU package, among others.

“There are definitely a lot of variables that play a role when it comes to the market internationally,” explains Mazouz Sahm, Euro Group vice president of global business development. “An increase in sustainability usage, project management software and design software” such as digital twins and BIM, he adds, are also changing the way design firms work collaboratively at a global scale.

Market Challenges

With markets in flux, Manuel says owners need a “trusted partner that can assist in making informed, data-driven decisions” that “can demonstrate value not just in one element of a project but the whole lifecycle.” The Top 225 take varied approaches to achieve these goals.

Jean-Charles Vollery, Group COO of SYSTRA, says there are three main challenges facing the international design market: climate change, lack of talent resources and rising materials costs. Particularly, he says, increasing energy costs and raw materials “can challenge the delivery of major construction projects.”

He adds: “There is still uncertainty as to the end effect of inflation on growth, debt and public investment in infrastructure. However, this represents a great opportunity to boost sustainable design solutions when it comes to energy efficiency.”

“Our digital approach has been proven to reduce the investment costs and lead times of large and complex infrastructure projects.”

Stéphane Aubarbier, COO, Assytem

Acknowledging an increase in conversations with clients about how to address climate change and environmental concerns, Vollery stresses that reducing a project’s carbon footprint is no longer viewed as going far enough. “The direct and indirect environmental impacts of entire projects must be taken into account throughout their entire lifecycle,” he says. “For client needs, this translates into specific requirements in terms of following environmental references and regulatory compliance.”

In January, a consortium of SYSTRA, Italferr and Egis won a $33-million contract to prepare, procure and supervise the control-command and signaling subsystem for the overall $5.8-billion Rail Baltica. Project designers aim to bake in sustainability from the ground up while also fostering sustainable development in hubs around the new rail line connecting Estonia, Latvia and Lithuania into Poland.

With increased demand for high-performance, sustainable transport infrastructure—a trend SYSTRA is also seeing in Australia, Scandinavia, India and Canada—comes a higher demand for innovation and long-term staff support from design firms, says Vollery.

For No. 58-ranked Assystem, digitalization has been a key driver of innovation that expands firm capacity, says COO Stéphane Aubarbier.

“Our digital approach has been proven to reduce the investment costs and lead times of large and complex infrastructure projects by optimizing the organization of the project,” he says. “These new abilities have bolstered our already strong reputation for delivering on time, within budget, and digitalization has provided us with numerous new ways of solving existing problems while maintaining the same stringent safety standards.”

Of the Top 225 design firms, 190 filed backlog data, with 68.9% saying their total is higher than a year ago and 9.4% noting a decline. Last year, 23.9% said backlog was lower, illustrating that projects are indeed moving forward despite market challenges and changes.

The annual International Construction Costs (ICC) index published by Arcadis NV reported double-digit inflation across markets, particularly in the U.S. and parts of Europe. Despite federal infrastructure spending, the pandemic and the Ukraine invasion are still stretching supply chains and slowing logistics in certain regions, says Arcadis Chief Growth Officer Mary Ann Hopkins.

“This has created the biggest products and materials squeeze in 30 to 40 years,” she says. “To combat this, innovations are helping shift cost away from labor, materials, and waste—all examples of opportunities discussed by our industry for years with now [being]the time to walk the talk.”

Buildings | By Jonathan Keller

Dewan's Green Living

Photo courtesy of Dewan Architects + Engineers

Dewan Architects and Engineers (No. 105) is designer on the Solforest Ecopark project, a 129,000-sq-m mixed-use development located outside Hanoi, Vietnam. Inspired by the developer’s request for an urban building in a rural setting, the structure’s two main towers, rising 42 and 35 floors, feature vertical gardens providing residents with ‘green’ views from their windows.

Fueling the Energy Transition

The politics surrounding the war in Ukraine have forced many countries to take sides in the conflict, creating international tensions and making it more difficult for Western companies to work in the East, with design firms sometimes caught in the middle, says Assystem’s Aubarbier. For the nuclear energy sector, this could quickly become problematic for companies in the supply chain, with Russia a key player in driving new civil nuclear programs, he explains.

If petroleum prices plummet from current highs like they did at the peak of the pandemic, that “could also affect the amount of investment that the oil-producing countries in the Middle East allocate to their infrastructure projects,” adds Aubarbier.

Political stability in the countries where design firms have work is also crucial, says Onur Başkaner, vice president of Yüksel Proje. Using Libya as an example, a country that was popular among Turkish firms, Başkaner says “we currently cannot provide contracting and technical consultancy services as we did before the internal turmoil in Libya.”

On the other hand, digitilization has enabled many design firm projects to continue remotely despite challenges on the ground.

“The fact that the administrations have conducted online tenders using tender portals can be interpreted as a positive development in reducing paper wastage, traveling, cargo expenses and carbon emissions,” says Başkaner. “The increase in online interaction during this period can also be considered a positive aspect of the pandemic.”

Top 225 design firms based in Europe have weathered the pandemic in good shape, with some noting double-digit annual growth. Revenue that Top 225 reported in Asia and Europe for this year's list and for 2021 increased the most, up 16.3% and 13.9% respectively.

Revenue from the Middle East and Canada fell the most, down 20% and 17.6% respectively. However, it should be noted that last year’s listed top firm in the Middle East, Tecnicas Reunidas, did not file a survey this year. The firm had $1.2 billion in Middle East revenue reported on the 2021 list.

With the war in Ukraine pushing up energy prices, a rush to displace Russian gas and oil is creating opportunities to compensate for an emerging decline in some traditional sectors.

“The war has accelerated the push for independence from fossil fuels and [for] the green transition,” says Lars-Peter Søbye, president and CEO of Denmark’s COWI A/S. He expects demand in these sectors to grow “at speeds we haven’t seen before.” A key challenge now is to recruit and retain staff with the necessary skills, he adds.

Like other international design firm leaders, Søbye says “the market for the moment is very good,” reporting 8% sales growth and a “robust order backlog.” But inflation is softening residential building demand and infrastructure will likely follow, he adds. Søbye foresees a slowdown starting by the end of 2022 and fears it might last two to four years, depending on how the war goes.

UK-based Mott MacDonald Group’s new executive chair, James Harris, also has forebodings. “In the last weeks we have started to see question marks over the next 18 to 24 months,” he says. But for now, “business is good [and] we continue to be busy in all of our ... geographical markets and across all our sectors.”

Hong Kong, one of Mott’s key regional markets, is “strong and stable,” while demand in Singapore is recovering after dropping “significantly” during the pandemic.

Harris also reports growing interest in energy transition. “Just two years ago in Australia, there was a lot of political ... denial about climate change,” he says. “Now we are seeing some real positive leadership and I think that’s happening in most parts of the world.” Mott MacDonald is “duty bound to support that effort,” Harris says.

Market share of the Top 225 list for Canada-based firms rose to 18.9%, more than double the number from a decade ago. Stantec, SNC-Lavalin, Hatch Ltd. and WSP Global appear in the Top 20, combining for over $12 billion in revenue. WSP Global ranks in the top spot for the second consecutive year.

Core markets for SNC-Lavalin’s engineering, design and project management team, Atkins, remains strong, says Philip Hoare, unit president. In all of Atkins’ regions, “energy transition really is going up the agenda,” with renewables, clean power and nuclear energy providing “exciting market opportunities,” says Hoare. Engineering net-zero projects is “the North Star of SNC Lavalin’s work,” he says.

While the Ukraine war is affecting the workload of European design firms, its direct impact on specific projects has been limited.

What little work Sweden’s Sweco Group had in Russia stopped, and its involvement in Ukraine’s energy efficiency and district heating schemes “unfortunately needed to end,” says Åsa Bergman, president and CEO.

Netherlands-based Royal HaskoningDHV “terminated all our ongoing projects in Russia and Belarus,” says Marije Hulshof, its global director of industry and buildings, who recently became the third member of its executive board. With little prior involvement in those countries, she says “the impact on our company will be marginal.” Outside of this, business for Royal HaskoningDHV has also been good, says Hulshof, with “sales revenue growing [and] some interesting acquisitions lately.”

Mott MacDonald’s Harris says "projects we were involved with [in Ukraine] when Russia invaded are all continuing, with energy-related work funded and being handled from outside Ukraine. But he is keen to support eventual efforts to rebuild war-torn Ukraine. “We’ve been talking to the U.K. government about how we can support similar sorts of organizations and contractors,” he says.

Sweco also is “preparing and planning to be part of rebuilding Ukraine,” says Bergman. Additionally, COWI is working with the European Investment Bank and other international lenders on plans to rebuild the war-torn country, adds Søbye. While the war is causing extensive damage to infrastructure there, the impact on food supplies will be wider, he says. With famine on the horizon, Søbye questions what impact large refugee movements would have “on our customers’ customers.”

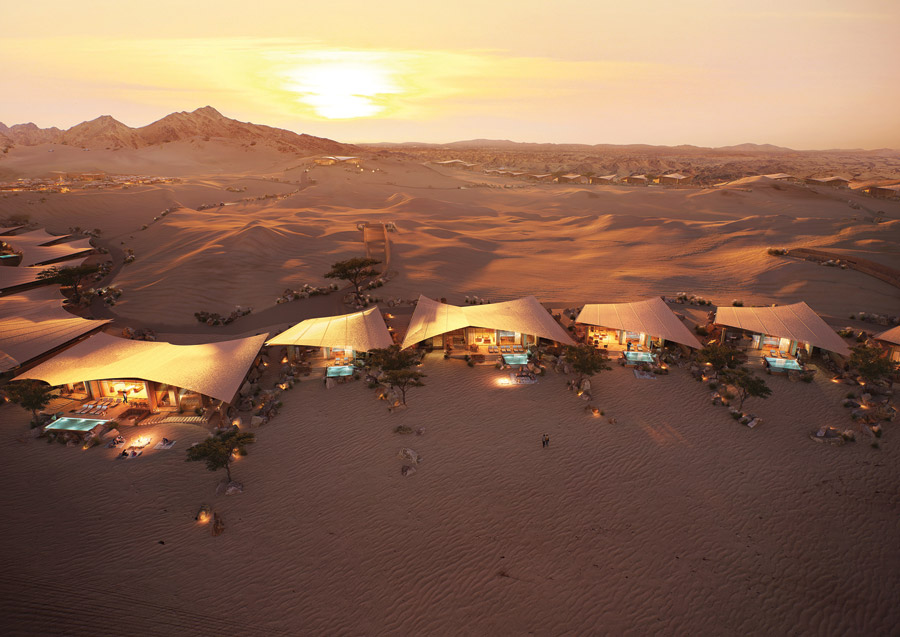

Hotels/Hospitality | By Jonathan Keller

Stantec's Southern Dunes

Rendering courtesy of Stantec

Situated in the deserts of Tabuk Province on the west coast of Saudi Arabia, the Southern Dunes Hotel is one of 50 luxury hotels being developed in the region as part of the country’s broader Saudi Vision 2030 program. Stantec (No. 8) provided engineering-design services on the project, aiming for LEED Platinum certification. Designed to emulate the surrounding dunes, the project challenged the firm to achieve the correct aesthetic while meeting sustainability goals. “The huge shade structures became a major, unique, structural engineering challenge,” says Gord Johnston, CEO of Stantec. It required the firm to run hundreds of iterations of models to ensure the shades met both structural and aesthetic requirements, he says.

A bespoke grade foundation was introduced to limit soil disturbance, and dark-sky lighting techniques were used to reduce light pollution.

Cooling was also a major problem. “We designed thermal storage tanks to store thermal energy generated in daylight hours as cold water, to negate the need for power cooling from chillers during peak hours, thus offsetting the peak loads,” remarks Johnston. The design also focused on avoiding concrete or stone to minimize retained heat and used lightweight materials to maximize offsite construction and energy efficiency.

The hotel is due to open in 2023.

Changing Climate Attitudes

Longer term, SNC-Lavalin’s Hoare sees climate change potentially displacing huge numbers of people globally. Countering this possibility by improving resilience is providing “a massive opportunity,” he says. “In the infrastructure space [we have] a pretty interesting few years ahead.”

Royal HaskoningDHV's Hulshof says even owners in traditional industries have been committed to addressing climate impact and sustainability. “When COVID came we really saw some companies” come to a hard stop with investment. Despite current market challenges, “we don’t see that yet ... but of course everybody’s [holding] their breath,” she adds.

Bergman traces changing attitudes on climate change to the pandemic, when “everything around sustainability was put really high on the agenda.” The invasion of Ukraine “accelerated the focus on energy transformation,” she adds. “Investment in the energy sector is going to be heavy [in] production, distribution and storage.”

COWI is so committed to decarbonizing its business that “within three to five years 100% of our project [sales] must come from supporting the green transition,” says CEO Søbye, who is stepping down on Oct. 1 after 14 years in the role to become a firm executive adviser.

Sobye, to be succeeded by Jens Højgaard Christoffersen, chief business development officer, notes that the company stopped this past March taking on new fossil fuel related work. "We've only just embarked on the green transition," Sobye says.

Royal HaskoningDHV has developed a “purpose matrix” to help assess its projects against five criteria, including climate change, biodiversity, resources and circularity, says Hulshof.

“We want to have that internal dialogue and to give our staff a framework to engage with their clients,” she adds. “We see a lot of our clients in ... more traditional industries making that transition.” The challenge in key markets is “about getting the resources. It’s not about getting the work,” says Hulshof.

For Hoare and Harris, competition for staff is unprecedented. Energy transition “is one of the hottest markets,” says Harris, adding that in addition to more staff recruiting, “we have also set up a renewable energy academy within the business. That’s about reskilling those people who maybe had a career in more traditional areas.”

In current conditions, being flexible and managing scarce human resources “will be the key to success for the coming six to 12 months,” says Søbye. Companies able to “relocate and upskill their staff into the green transition will be the winners,” he adds.

Technology-Driven Design

As international economies move to prioritize climate goals, many of GHD’s fastest growing services are “about helping clients develop future energy systems such as hydrogen, offshore wind, pumped hydro or renewable natural gas,” says CEO Ashley Wright. “Our focus is not limited to just energy, and we are also working with clients to improve water management and develop more resilient communities around the world.”

To keep client carbon goals top of mind, many Top 225 firms are turning to technology.

SYSTRA developed Carbontracker to measure, monitor and control emissions at every stage of a client’s infrastructure project. Compatible with BIM technology, the tracker collects “carbon data” from BIM models to design optimized avoidable emissions.

“Major trends in the construction sector are towards the use and integration of intelligent and smart systems in every aspect.”

Murat Koru, Chairman, Proyapi

“Major trends in the construction sector are toward use and integration of intelligent and smart systems in every aspect,” says Proyapi Chairman Murat Koru. “It is a well-known fact that construction work and engineering consultancy are only 20% of the project cost during its lifetime. On the other hand, operation and maintenance is 80% of the total cost.”

New intelligent systems need to be considered during design and construction to reap the benefits during the operation and maintenance period, he adds. “These new systems do not only facilitate the operations and lower the cost, but also lower energy consumption, promote safety and eliminate human-made mistakes.”

Typsa Group President and CEO Pablo Bueno Tomás says potential buyers are increasingly “asking for in-built systems capable of measuring, capturing and saving energy consumption.” With environmental consciousness, there is also increasing demand for flexible buildings that use technology to adapt to the external conditions.

“Regarding recyclability and circular economy, we are being asked more and more to analyze the reuse of existing infrastructure and built elements to reduce the new build and minimize the carbon footprint in buildings,” he says.

Tomas also emphasizes that “migratory pressures and the enormous infrastructure deficit in most of the world prove that some development aid policies must change soon.” Once a change to regional developmental policies take place, “as it must in the immediate future,” he says, “the international design market will grow tremendously.”

Then, Tomas adds, the world's economies will be open to business opportunities from global design firms with experience in these fields.

-Tideway-Aurecon_ENRready.jpg?height=200&t=1627594016&width=200)

Post a comment to this article

Report Abusive Comment