ENR Southwest’s annual survey of design and engineering firms reveals that revenue for the region’s largest companies grew in 2016.

This year’s survey includes 61 firms, down one from last year, but those firms earned a combined $888.93 million in design revenue in 2016. That is up nearly $100 million from last year.

Revenue for the top 10 increased to $433.61 million, compared with $357.68 million in 2015 and $318.34 million in 2014.

Some in the industry say that while signature, high-cost projects are being built, staying strong in the current market means being able to perform more smaller projects.

“Geographically, one of the things that has been interesting is project size,” says Daniel Aguirre, senior vice president at Wilson & Co. “We are doing more projects that are smaller. Maybe the economy hasn’t quite caught up to that. That is not necessarily the case in every state, but definitely in the Southwest.”

ENR Southwest 2017 Top Design Firms Chart

Competition Ratchets Up

Firms like Wilson & Co., which have a strong history in the region, are facing new competitors as the Southwest is being targeted by firms looking to capitalize on future growth, Aguirre says.

“There are many very large firms to compete against today,” he says. “But we compete by having strength in our specialties and the ability to offer more value over a firm that may have more resources.”

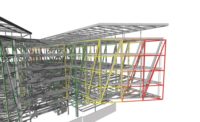

For example, he says that firms that have fully integrated into 3D and BIM design tools have cost and reliability advantages. But incremental increases in productivity cannot be counted upon forever, as the systems are nearing their maximum productivity, he says.

“Computers and software can do a lot of things for us now, and we are at the tip of the spear,” Aguirre says. “We are doing more with less than we used to. I don’t know how much more that can continue.”

Defining the line where design and engineering allow automated systems to do the work needs to be a topic of discussion and should be addressed by the industry in the coming years, he says.

Imaging Helps With Details, Customers

Beyond aiding with constructibility, design firms in general and architectural firms in particular are using computer-based systems to enhance communication with clients.

Brad Woodman, vice president at SmithGroupJJR, says allowing owners to tour facilities via virtual reality software has been invaluable to winning contracts and ensuring quality results.

“Now you can bridge the gap that existed between the 2D drawings and the finished project,” Woodman says. “The last thing we want to do is surprise anyone.”

Over the past year, many insiders have seen the regional construction industry bounce back from the lows of the great recession, but not all.

“The pent-up demand has brought us some successes. It is a little hotter (on the) owner side and not the developer side,” Woodman says. “Residential construction and other sectors that have seen their heyday in the last three years are starting to slow.”

Woodman says the federal sector has been especially slow in expanding, after stimulus spending ended five to seven years ago.

“It was fairly flat in the last administration, and we are not really sure what this [new] administration is going to do,” he says.

Post a comment to this article

Report Abusive Comment