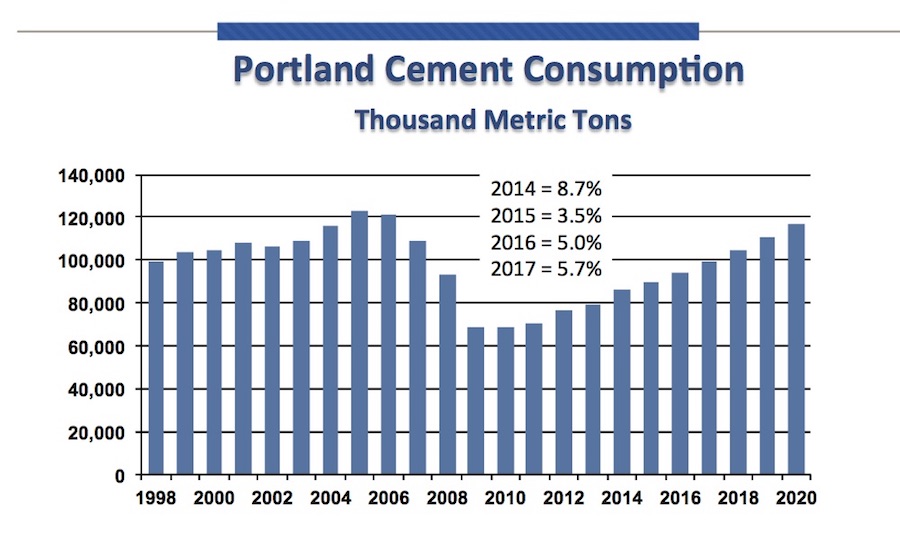

LAS VEGAS—Citing pent-up construction demand and positive economic indicators, Portland Cement Association chief economist Edward Sullivan said on the first day of this year's World of Concrete show that he expects to see a 5% growth in portland cement consumption in 2016, with a further 5.7% growth in 2017. This is an improvement over the growth rate from 2015, which was only 3.5%.

“These are the latest numbers from our November forecast, which didn’t include the effects of the FAST Act,” said Sullivan, citing the importance of the recent multiyear, federal transportation bill to the public construction sector. “That spending will help overcome the effects of inflation, and also offset the drag due to lower oil prices. The FAST Act should be praised.”

Sullivan gave his forecast at this year's World of Concrete, held Feb. 2-5 at the Las Vegas Convention Center. While the overall forecast was positive, Sullivan cautioned that there were some signs that may cause PCA to revise its forecast when its updated in March.

A drop in oil prices and a economic slowdown in China are possible headwinds for the construction sector, he commented. The effects of low oil prices have not been fully seen in the cement industry. Lower fuel costs frees up funds that might otherwise be spent on materials, but the decline in oil production will have short-term negative impacts on cement demand. A drop in oil has not yet translated into a drop in asphalt costs, Sullivan said, adding that he expects concrete paving to remain competitive for the near future.

But a rise in construction may not directly correlate to a rise in the cement market. “Real construction activity grew 6.1%, but cement consumption is only up 3.8%,” said Sullivan. “The only reason for this is that the cement intensity per dollar of construction has declined." According to Sullivan, a decline in cement intensity can be an indicator of retrenchment, or negative growth. "It's concerning. It's usually kind of an advanced indicator. It doesn't always work that way, and we don't think it will work that way in 2016. But is does have a track record of that," he explained.

Sullivan also noted a possible negative indicator from some recent reports from Dodge Data & Analytics. “There has been a dramatic decline in the Dodge contracting awards for the last six months,” noted Sullivan. “If there is something happening in the market to suggest a retrenchment, we should be concerned if non-residential construction has slipped.”

“But are the fundamentals otherwise sound? I’d say yes,” he concluded.

Post a comment to this article

Report Abusive Comment