With the recent news of AECOM’s acquisition of URS, followed by their subsequent purchase of Hunt Construction, it seems like the big just keep getting bigger. If AECOM was a mega-firm at 50,000 employees, what is it at 95,000? Since a gigabyte is larger than a megabyte, it stands to reason that AECOM is the industry’s only giga-firm! Or have they made the leap to tera-firm size?

But what’s the reality about firm size in the A/E/C industry? Is there a such thing as a “normal” sized firm? Well, our friends at the U.S. Census Bureau have something to say about that. Of course, their data is usually lagging a few years behind by the time it is published, but there’s still some useful information to be found in the 2011 Statistics of U.S. Businesses, the most current data available.

I looked at firm size and employment for five categories:

(1) Non-Residential Construction

(2) Heavy and Civil Engineering Construction

(3) Specialty Trade Construction

(4) Architecture

(5) Engineering

The first thing that really jumps out is that the vast majority of firms in the A/E/C industry are small, regardless of category. Between 83% and 94% of firms in each category employ less than 20 people. The second thing that leaps off the data tables is that the absolutely largest firms in each category, those with 500 or more employees, represent no more than 1.15% of all firms – yet they employ anywhere from 11% to 47% of the representative workforce. Let’s break it down by type of firm.

For Non-Residential Construction, which the Census further breaks down into Industrial Building Construction and Commercial & Institutional Building Construction, roughly 86% of all companies employ less than 20 people. These firms represent about 30% of the workforce. Although only 12% of companies employ 20-99 people, they account for almost one third of all employment – the largest segment. As for the mega-firms, which for this blog I’m simply defining as those with more than 500 employees since it is such a tiny sample size, one-half of one percent of companies employ more than 21.5% of the Non-Residential Construction workforce! Averages aren’t particularly useful when looking at such a large range of firm sizes, but based upon Census data, the average (mean) firm employs 14 people.

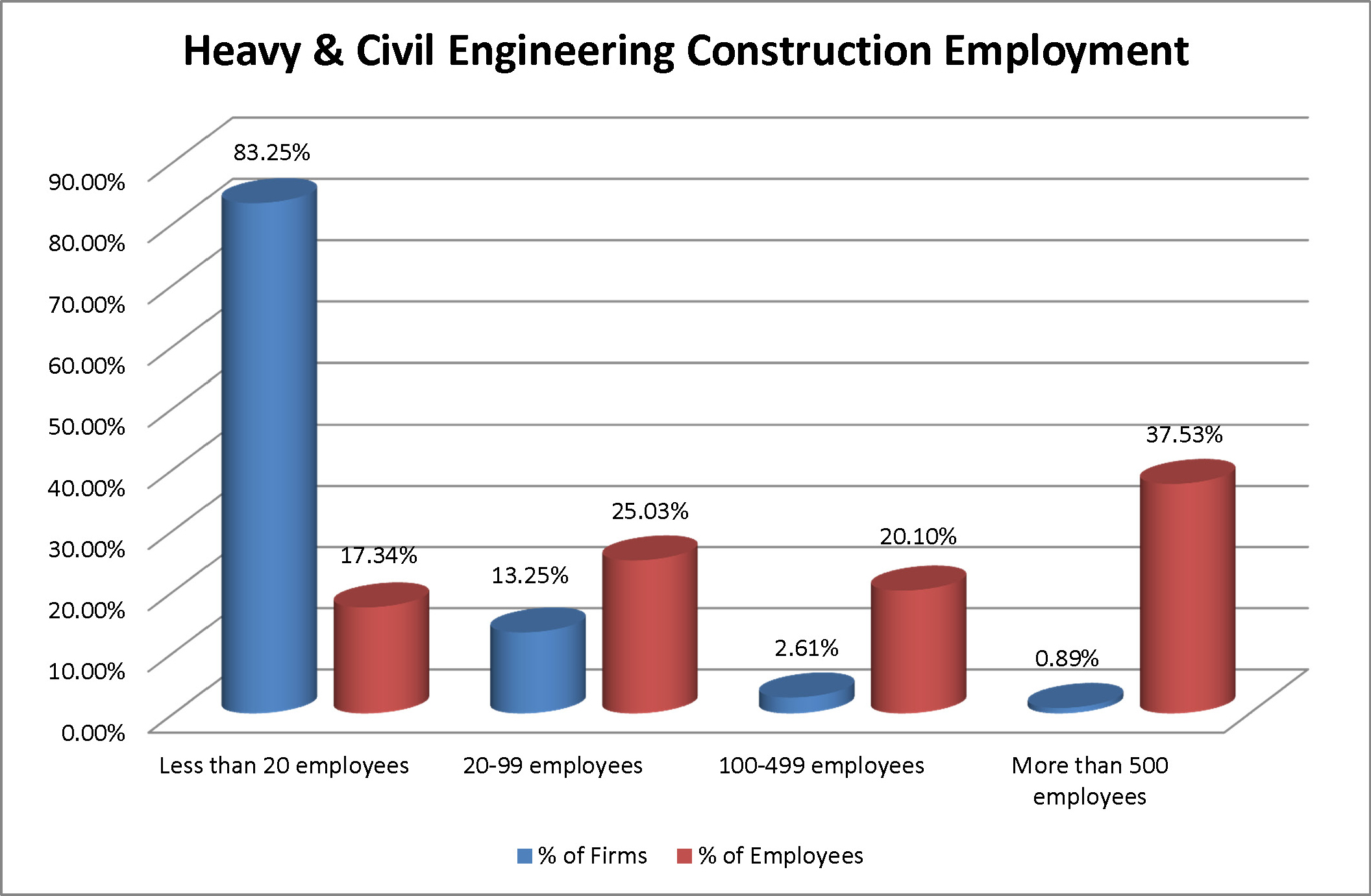

Next up is the Heavy & Civil Engineering Construction category, which includes the following:

• Utility System Construction

• Water & Sewer Line/Related Structures Construction

• Oil & Gas Pipeline/Related Structures Construction

• Power & Communications Line/Related Construction

• Land Subdivision

• Highway/Street/Bridge Construction

According to Census data, slightly more than 83% of firms have less than 20 people, but they only employ 17.3% of the workforce. At the other end of the spectrum, fewer than one percent of these construction firms employ almost 38% of the total workforce. The mean for firm size is 21 employees.

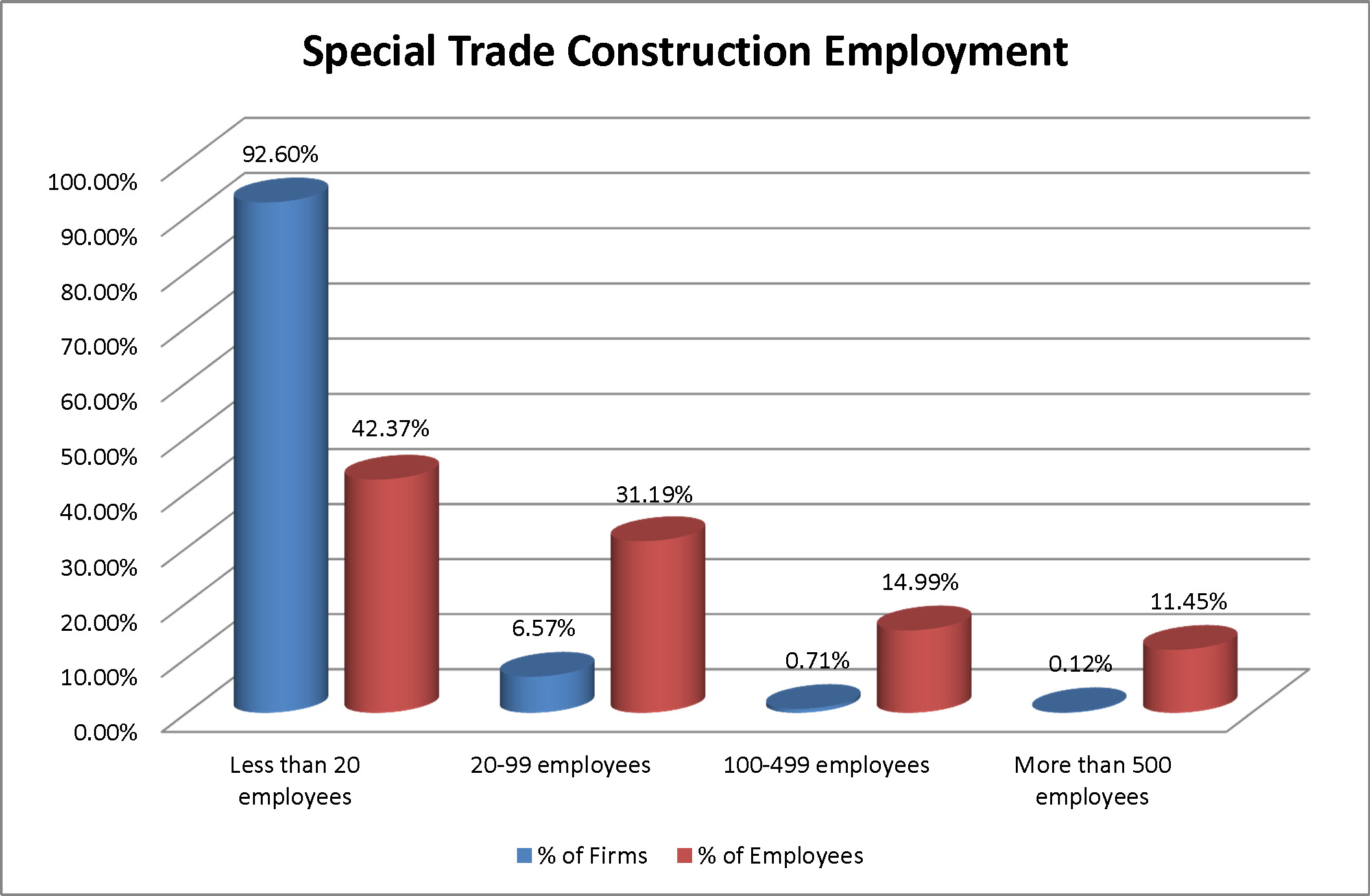

Specialty Trade Contractors are a very broad category that includes:

• Foundation/Structure & Building Exterior Contractors

• Poured Concrete Foundation & Structure Contractors

• Structural Steel & Precast Concrete Contractors

• Framing Contractors

• Masonry Contractors

• Glass & Glazing Contractors

• Roofing Contractors

• Siding Contractors

• Building Equipment Contractors

• Electrical Contractors & Wiring Installation Contractors

• Plumbing/Heating/Air Conditioning Contractors

Within this segment, small firms are the norm, with almost 93% of companies employing fewer than 20 people and representing more than 42% of the workforce, the single largest segment. The mega-firms aren’t too common in this category, with only 0.12% of firms employing more than 500 people, representing fewer than 12% of the total workforce. For this category, the mean employment per firm is 8 people.

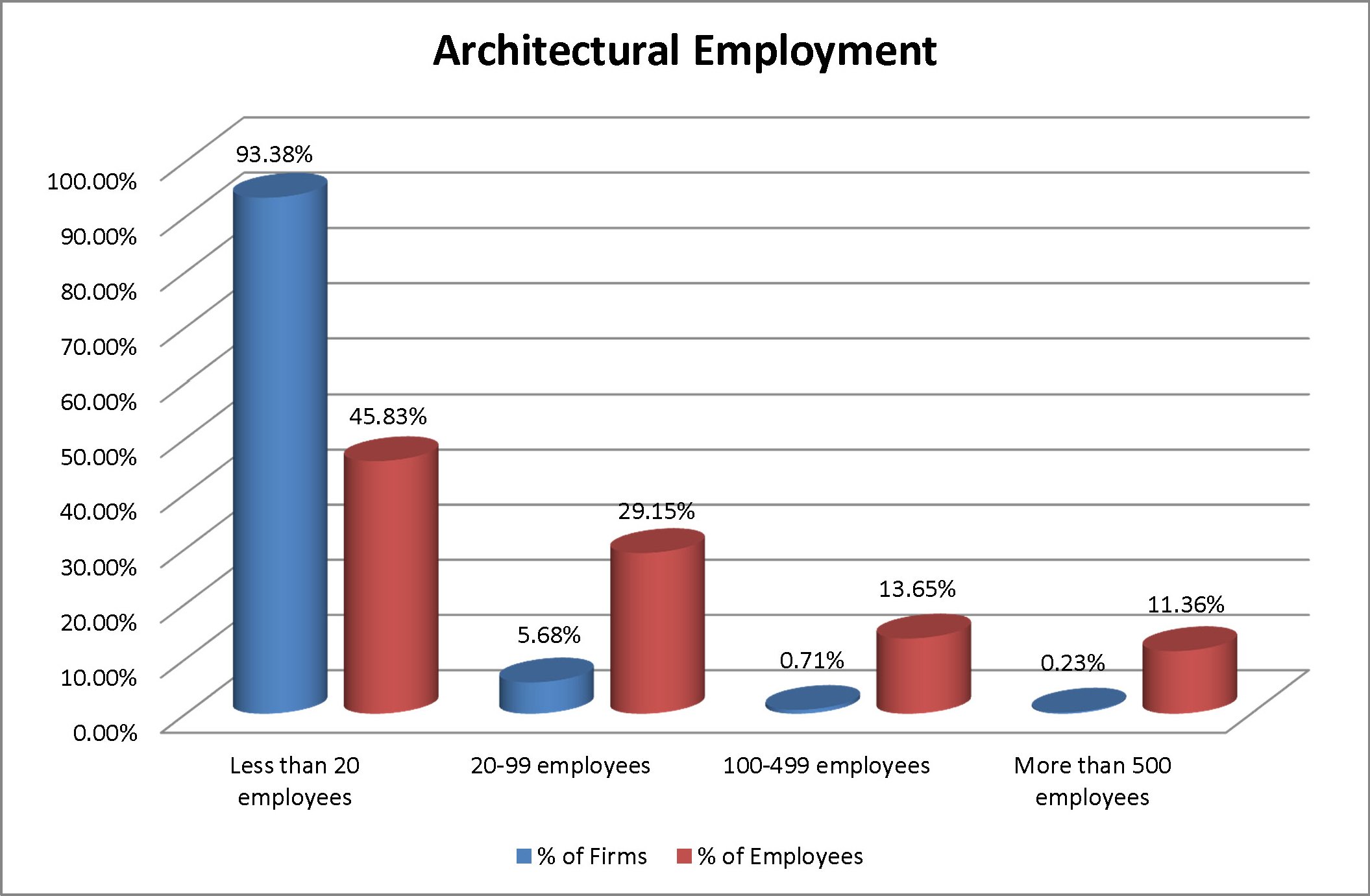

The numbers for the architectural profession are also striking. More than 93% of architectural firms in the United States employ less than 20 people, and they represent almost 46% of the architectural workforce. The next most common segment is the 20-99 employee range, which comprises less than 6% of the firms but almost 30% of the workforce. As for the mega-firms, they are a very small component of the industry, representing only 0.23% of all firms, although they do employ more than 11% of all architects in the country. The average architectural firm, based upon mean, employs 7 people.

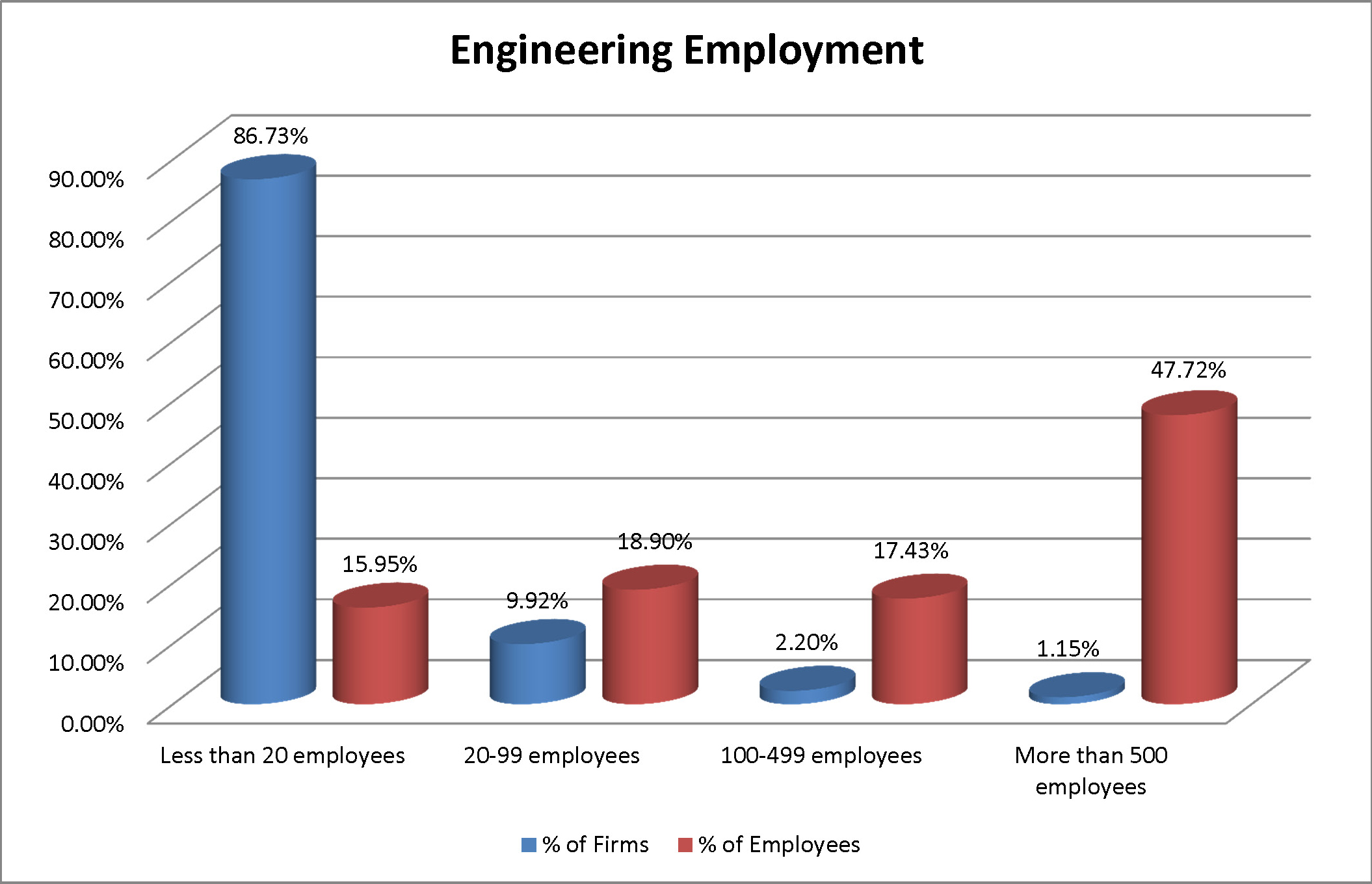

Perhaps more than any other category in the A/E/C industry, engineering firms show a huge divergence between number of firms and workforce employment. Approximately 87% of all engineering firms employ less than 20 people, yet in overall numbers, they only represent about 16% of the engineering workforce. However, the mega-firms, which only constitute slightly more than one percent of all engineering firms, employ a staggering 48% of the workforce. So while the vast majority of all engineering firms are small, close to 50% of all engineers work for only one percent of the engineering firms! Mean employment at engineering firms is 20 people.

But what does all this mean in terms of marketing and business development? Most small design and construction firms will tell you that a decade ago the mega-firms weren’t sniffing around their backyards, but since the onset of the Great Recession it seems as if those mega-firms have moved into the neighborhood. In many cases they have, literally, as the big have gotten bigger by acquiring smaller and regional design and construction firms.

This is the new norm, and a significant change in the A/E/C industry. Smaller firms need to leverage their local connections when competing against the large “out-of-town” firms, and differentiate themselves by committing the A-Team to a project, positioning against the B-Team or C-Team that the large competitor may be assigning to the project. Customer service is a key selling point, with the small firms able to promise that the project they are chasing will be extremely important to their firm, whereas the client may just be a small fish in a big pond to the larger firm.

Conversely, the large firms need to leverage their size as it relates to vast relevant experience and depth of staffing. Advanced technology capabilities can be a major differentiator here, as can risk mitigation because of the deep pockets of the larger firms. These firms may also be able to play the “local card” if they have a nearby office or have acquired a local firm.

So now that you’ve seen the pretty massive chasm between the resources of small and mega firms, what do you think of the make-up of the A/E/C industry? Are these stats surprising? How can these firms differentiate from one-another, and where does that leave the mid-sized firm?

Post a comment to this article

Report Abusive Comment