Most contractors expect construction demand to shrink in 2021 as the pandemic prompts many owners to delay or cancel planned projects, which means few firms will hire new workers, according to survey results released Jan. 7 by the Associated General Contractors of America and Sage Construction and Real Estate.

The new AGC Construction Outlook is based on survey results from more than 1,300 member-contractors from all 50 states and the District of Columbia.

"Our service department probably had a 25% decrease in revenue because of buildings being shut down. Offices, people still aren't back to work," says Rosana Privitera Biondo, president of Mark 1 Electric in Kansas City, an AGC member firm.

She said on a Zoom call, "Those one- hour phone calls or three-hour-call clients are not calling us because they're not even open for business.'

Biondo added, "Right now we're still seeing a downturn in new office [demand]. Buildings are being completely shut down. The new construction has been reduced to a minimum here in Kansas City as far as office buildings are concerned."

Only one-third of the contractors surveyed say their business is back to its year-earlier level. Another 12% believe it will bounce back within the next six months, but 55% of companies say it will take more than six months—if ever— for business to get back to the year-earlier volume.

“This is clearly going to be a difficult year for the construction industry,” said Stephen Sandherr, the association's chief executive officer. “Demand looks likely to continue shrinking, projects are getting delayed or canceled, productivity is declining, and few firms plan to expand their headcount.”

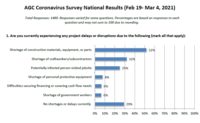

Moreover, 59% of contractor-respondents reported they had projects scheduled to start in 2020 that have been postponed until 2021. And 54% said they had projects canceled in 2020 that have not been rescheduled.

"The net reading for the percentage of respondents who expect the available dollar value of projects to shrink compared to the percentage who expect it to expand is negative in 13 of the 16 categories included in the survey," says Ken Simonson, AGC chief economist. "Contractors are most pessimistic about the market for retail instruction, which has a net reading of negative 64%."

A negative reading means the percentage of respondents who expect a market segment to contract exceeds the percentage who expect it to expand by that percentage.

Hiring Outlook

Only 35% of the contractors surveyed said they plan to add staff this year; 24% said they plan to decrease their headcount in 2021 and 41% expect to make no changes in staff size.

"You can't put a bartender or a waitress on a motor grader," said Bob Schafer, president at asphalt contractor Ranger Construction Industries in West Palm Beach, Fla. "We would love to, and we'd love to help that industry out, but it just, it's not possible."

Schafer added, "Those are not the skill sets that we require....We are still looking for skilled workforce. We admittedly did not do all the training that we would like to do in a normal year [in 2020] because last year just was not normal."

Hope for Help From Washington

Sandherr said the group will push Congress and the incoming Biden administration to enact legislation providing funds to support state and local governments' construction budgets.

Sandherr also said AGC will seek to educate the incoming Congress and administration about the risk of imposing "some new regulatory measures while the economy remains crippled by the pandemic."

"Even as we work to advocate for measures to rebuild demand for construction, we also need to take longer term steps to continue developing the construction workforce," Sandherr says. "AGC is addressing workforce challenges by crafting a new plan that focuses on continued advocacy, helping chapters and members establish or improve training programs and launching a new national workforce recruiting effort."

Sandherr and Simonson expressed optimism that the new Congress and Biden administration may be able to deliver what was an elusive infrastructure package for the last four years.

They noted that even a Congress with both houses under the same party's control can move slowly. Sandherr said he hoped that the animosity and unrest witnessed at the U.S. Capitol on Jan. 6 had united the parties.

"There'll be an orderly transition of the government," Sandherr said. "Yesterday had the unintended effect of uniting folks up on Capitol Hill and perhaps temporarily putting aside political differences and recognizing that it's important that the country unify at this time."

IT Forecasts

Dustin Anderson, vice president and general manager of construction technology provider Sage said 62% of contractors indicated that they currently have a formal IT plan that supports their business objectives, up from 48% last year.

An additional 17% of contractors plan to create a formal process plan this year. Most firms plan to keep their technology investment at about the same level as last year.

Moreover, 55% are using mobile technologies for sharing drawings, photos and documents; 44% say it’s difficult to find time to train staff for new technology. Among the respondents, 43% listed employee resistance as a top challenge, up from 38% last year.

Post a comment to this article

Report Abusive Comment