COVID-19 has prompted project delays and cancellations, as well as layoffs and furloughs, yet it remains difficult for most contractors to find craft workers, according to results of a workforce survey conducted by the Associated General Contractors of America and software vendor Autodesk.

About 2,005 AGC member contractors responded to the survey.

The analysis found that 60% of respondents reported having at least one future project postponed or canceled, and 33% said projects already underway were halted. Work is taking longer: 44% of contractors said it has taken longer to complete projects and 32% say it has cost more to complete ongoing projects because of the coronavirus.

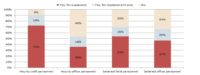

Despite that, a shortage of labor remains, with 52% of respondents report having a hard time filling some or all hourly craft positions and only 3% of firms reducing pay, despite the downturn in business. About 50% of contractors are not altering headcount and 23% added employees., according to the survey.

Technology adoption is on the rise due to distancing measures and other factors changing how contractors complete their work. About 40% of responding contractors said they have adopted new hardware or software to alleviate labor shortages.

Nearly one-third of respondents have furloughed or terminated employees as a result of the pandemic due to shutdowns ordered by government officials or project owners.

Most have asked at least some laid-off workers to return to work. But 44% of contractors say that at least some employees have refused to return, citing unemployment benefits, virus concerns or family issues, among other reasons.

"Few firms have survived unscathed from the pandemic amid widespread project delays and cancellations,” said Ken Simonson, AGC chief economist. “Ironically, even as the pandemic undermines demand for construction services, it is reinforcing conditions that have historically made it hard for many firms to find qualified craft workers to hire."

The survey says 89% of respondents indicated they believe some form of government action is necessary to drive economic recovery, with only 11% saying that no additional legislation is needed. Accoding to the report, 55% said that a larger federal investment in all forms of public infrastructure and facilities would be helpful.

Responding firms are still struggling with how to return to work safely six months after the pandemic began, with questions stilll unanswered about future planning for clients projects their own work environments, said Allison Scott, director of construction thought leadership at Autodesk.

"More and more questions are coming up from our customers around how to address new space planning requirements in a COVID-safe way," she said. "Some of the research that we have developed actually begins to address this very question, because it's not just about how people return to work, but also what are facilitiy maintenance issues? How do we address safe conditions and working environments? Those, those are big questions that not everybody has the answers to right now."

Among responding contractors that identified primary market segments of work, 56% are involved in building construction; 25% are involved in highway and transportation construction; 23% perform federal construction projects and 23% work on utility infrastructure.

Among firms that identified annual revenue, 66% report $50 million or less; 28% report between $50.1 million and $500 million; and 6% report more than $500 million.

Post a comment to this article

Report Abusive Comment