Within industry, supply chain is a well-understood and meaningful phrase. Managers, Directors and Vice Presidents of Supply Chain are hired. A large network of supply chain consultants provide continual services to enhance manufacturing and logistics processes. Raw products, shipping, manufacturing, distribution – all parts of the supply chain.

But there is also a supply chain within the architecture/engineering/construction (A/E/C) industry, only it is not nearly as well understood. Often, when discussing this industry's supply chain, the default view is that the supply chain relates to construction materials, and getting them to a construction site.

While that is a piece of the supply chain, it is only a piece – and a small one at that. And in an era when firm vs. firm competition has given way to supply chain vs. supply chain competition, it is prudent for A/E/C firm leaders, marketers, and business developers to understand the overall industry supply chain.

In fact, newer product delivery methodologies like P3 and IPD are directly related to integrating the supply chain.

So what is the A/E/C supply chain?

It depends upon what type of firm you are.

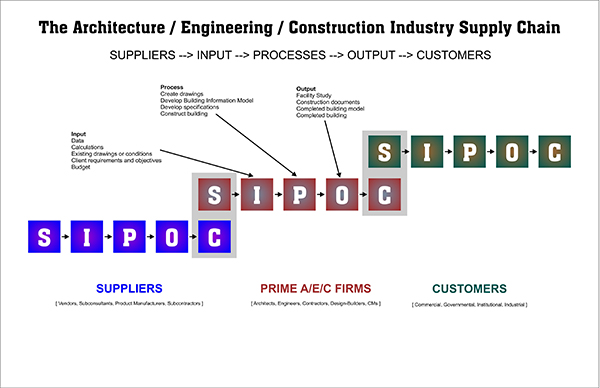

The A/E/C supply chain. Suppliers and Customers have their own supply chains. An A/E/C firm controls their IPO, or Input, Process, Output. Inputs include existing drawings or conditions, client requirements, budgets, or calculations. Process for an A/E/C firm could be creating drawings, developing building models, writing specifications or, for contractors, constructing the building or system or structure. Outputs include studies and reports, construction documents or completed models, or the finished project itself. It depends upon the type of firm you are.

If you offer architectural services, your engineering and specialty consultants are all part of your supply chain. So are the vendors whose materials you specify. If you employ temporary or contract staff, they are part of your supply chain as well.

And the MEP engineering consultant? Well their supply chain includes vendors of HVAC and lighting equipment, temporary or contract staff, and specialty consultants that work with them (perhaps a fire protection consultant).

For a general contractor bidding on work, the supply chain includes the manufacturers of construction products – concrete, steel, etc. If they self-perform most of the work, their supply chain is smaller, but for a typical GC the supply chain includes mechanical and electrical subcontractors, site contractors, etc. – perhaps even carpenters and masons.

If that contractor happens to a design-builder, their supply chain may look different. Although some design-builders have full A/E services in-house, many go outside for some or all architectural and engineering services. Thus, A/E consultants are part of their supply chain.

As you can see, these are distinct but closely-related supply chains, with a lot of overlap.

In lean manufacturing and business terminology, you'll often hear a supply chain referred to as SIPOC, a type of process improvement that is found within Six Sigma methodologies. SIPOC is:

Suppliers –> Input –> Process –> Output –> Customers

Any firm controls its own IPO – Input, Process, Output.

For an architectural firm, the Input may be existing conditions, project program, square footage requirements, LEED requirements, etc. – anything that must be incorporated into the end-result.

The Process is the actual "doing," so for the architect it could be writing specifications, developing CAD drawings, creating a Building Information Model, etc. Most of the time and effort for a company is spent in the Process stage.

The Output in this example would be construction documents – 2D drawings, AutoCAD files, Revit models, final specifications, and more.

It is this output that goes to the Customer – the "C" in SIPOC.

However, the Output going to the Customer merely represents the "S" in their supply chain, and only one of many Suppliers to them.

For a general constructor, the Input may be drawings, studies, budgets, or building models, while the Process includes tasks like erecting steel, pouring concrete, installing lighting, etc. – essentially constructing the building or bridge or highway. The Output is the completed project, which is then turned over to the Customer. Again, the contractor is just one of many Suppliers in their Customer's supply chain.

Relevance in the A/E/C Industry

But what does all this have to do with you?

Think about that statement – "Supply chains compete with supply chains."

Are you continuing to look at your firm, regardless of the services you provide, as an independent island? Or do you understand that your island is part of a larger ecosystem?

When it comes to getting our firms commissioned, it is prudent that we focus on improving value throughout the entire supply chain. It's not just about A or E or C. It's about the entire continuum within the A/E/C industry – the manufacturers who create building products, the design community, the constructors and specialty consultants – literally every firm or individual who "touches" the process of planning, designing, constructing, and commissioning a building.

If you view your firm as a single entity – an island onto itself – you will continue to be at a competitive disadvantage in your pursuit of new opportunities and growth.

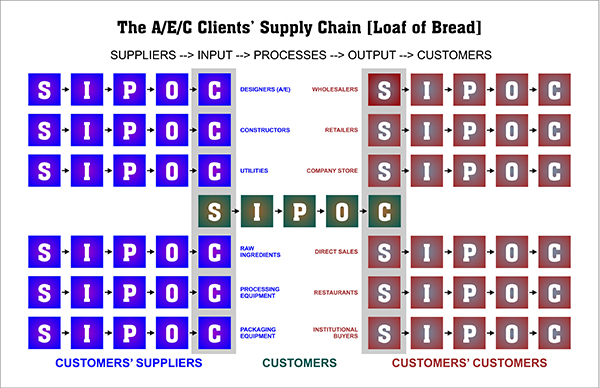

My firm, JDB Engineering, does a lot of work with food processing customers. So a bakery producing bread may have a supply chain that looks somewhat like this. There are many Suppliers – designers, constructors, utilities, ingredients, equipment. The bakery controls its Input, Process, and Output. However, it merely acts as a Supplier into its customers' supply chains. These customers could be wholesalers, retailers, company store, direct sales, restaurants, institutional buyers, and others.

It's no coincidence that many of the innovations in project delivery over the past few decades have directly addressed the supply chain – Public Private Partnerships (adding funding to the design and construction supply chain), Integrated Project Delivery (creating a cohesive design and construction team with shared risk), Design-Build (providing a single source for design and construction), and Construction Management (offloading management of the supply chain from the client/owner to a third party) – all these innovations directly address the limitations of a disjointed supply chain.

But according to the McGraw-Hill Construction SmartMarket report Project Delivery Systems: How They Impact Efficiency and Profitability in the Building Sector, only 2% of architects and contractors have been involved with IPD projects. In the same report, P3 is not specifically addressed; however, the DBO/M – Design-Build-Operate-Maintain – model was only used by 1% of architects and contractors.

Older supply chain innovations addressing part of the A/E/C supply chain have gained significant market share. These are Design-Build and Construction Management. However, the newer innovations like IPD and P3 occupy a tiny percentage of the overall project delivery methodologies currently in use.

How active are the construction material suppliers in your supply chain? Do you select and spec a product, or do you help them create products that your customers desire? Do you let the client find project funding by themselves, or do you introduce them to alternative ways to fund their project, like venture capitalists, angel investors, or government grants/incentives? Do you have strategic relationships with architects and interior designers? With mechanical, electrical, plumbing, civil, structural, and environmental engineers? With geologists and acousticians? With general contractors, site contractors, MEP contractors? With suppliers of construction equipment (sales/rental)? With construction managers? How about other, non-A/E/C suppliers in your customers' supply chains?

Sure, you probably know a lot of people at all these types of companies. But only when they become strategic partners and teammates will you be able to maximize the value of your supply chain – and more effectively compete against other supply chains.

Indeed, for this industry to evolve and truly realize significant, meaningful construction productivity gains, we need to understand that we are but a small piece of this massive industry, that our clients are really only concerned with the Output, and that the end-product they desire is but a single means of Input into their own supply chains.

What do you think? Has your firm maximized the supply chain to add value to your clients, or do you still think of yourself as a lonely island in a massive ecosystem?

Post a comment to this article

Report Abusive Comment