Use of building information modeling has grown from 28% to 71% in the construction industry in the last six years, and the profile of BIM users has also seen a major shift in the last three years, according to a recent McGraw-Hill Construction survey. In the first and second BIM SmartMarket Report research studies, published by McGraw-Hill Construction in 2006 and 2009, architects led the industry in BIM use by a substantial margin. In the most recent study conducted this fall, not only has the gap between players in BIM adoption narrowed significantly from a differential of 16% to one of 7%, but contractors are also now the leading users of BIM. Between 2009 and 2012, the percentage of contractors using BIM increased from 50% to 74%, allowing them to leapfrog over architects, 70% of whom now report using BIM.

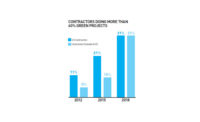

Contractors also expect to increase the percentage of projects on which they use BIM in the next two years. While they report growth between 2009 and 2012—with those using BIM on over 60% of their projects growing from 21% to 31% in just two more years—over half say they will be using BIM more broadly by 2014.

Value of BIM for Contractors

A higher percentage of contractors also report experiencing strong BIM benefits. More than 50% of contractors indicated that BIM was generating strong benefits in five different areas, a strong contrast to the other players, with over 50% of architects and owners rating only one benefit equally, and no benefit rated high by over half of the engineers. The one benefit selected by more than half of the architects and owners was also tops for the contractors: reduced errors and omissions in documents, perhaps most closely associated with BIM throughout the industry.

For contractors in 2012, the other two top benefits were reducing rework and marketing to new clients. While the ability to market new business and the reduction of document errors and omissions were also equally valued in 2009, more contractors using BIM in 2012 said they were able to reduce rework significantly. However, while many of the top findings remained similar between 2009 and 2012, contractors' experiences of other benefits have evolved in the last three years. Most strikingly, those who have seen a reduction in construction costs have gone from a little over one-third to just under one-half, a motivation for continued use of BIM. A similar jump but wider difference comes in those who are reducing project duration, thus dramatically increasing profitability.

Interestingly, the only significant decline is in the ability to offer new services. This suggests that contractors are finding ways to incorporate BIM into their existing capabilities more than using it to revolutionize their businesses. As the economy recovers and more work emerges, contractors should be in a stronger position to deliver new business by demonstrating their successful BIM experience on current projects. Despite the strong increase in those reporting multiple BIM benefits, contractors still are relatively conservative in how they estimate return on investment from BIM. The percentage of architects who expect to see returns greater than 25% rose between 2009 and 2012 while those indicating minimal or no returns on their BIM investments reduced significantly.

However, between 2009 and 2012, contractors report lower ROI for BIM at this point than architects, with one-quarter reporting minimal or no returns, one-quarter reporting returns over 25%, and the remaining half in between. This may reflect the surge in adoption, with high levels of investment made to support their use of BIM. It will be interesting to see if there is a greater shift to seeing higher levels of return over time as contractors increase their use of BIM to a broader portfolio of projects.

In the meantime, however, with contractors experiencing higher levels of BIM use and stronger benefits, it is not surprising that a larger percentage of them in 2012 than in 2009 feel strongly about what it will take for them to get a better ROI out of their BIM use. The results from other portions of the research study make it clear that contractors are focused more on their internal use of BIM than on its ability to help them interact with other players. Better multi-party communication, the factor selected by contractors as important by the highest percentage in 2009, is now sixth, dropping by 12%, while all of the other major factors increased. Factors that now take precedence include those most closely related to improving productivity and increasing prefabrication. In addition, most contractors are looking for time and cost savings, benefits already reported by a wide percentage of firms, but which could still be improved.

Implications for the Industry

The shift in the industry from more focus on BIM in the design community to a nearly equal focus in design and construction bodes well for the increased potential of integrated design, despite the lower emphasis contractors are currently placing on using BIM to work with other players. This may be due to two factors: lagging adoption among specialty trade contractors and, more importantly, reluctance by some designers to share their models.

Strikingly, more than one-third of all contractors using BIM report that the models they get from other players are in a proprietary format. Architects are typically very protective of their intellectual property rights when it comes to design, and this leads contractors to report experiencing much more frequent model sharing with trade contractors than they do with architects.

However, as the study demonstrates, BIM is now becoming commonplace in the construction industry, and as more owners expect models to be produced at the end of projects, the industry will need to increase model sharing to maximize the benefits and investment returns of BIM. Meanwhile, though, even without this benefit, contractors have drastically shifted from being drawn along the BIM path by other parties to becoming a major force in driving BIM adoption. They are changing how work is done because of the strong BIM benefits they are experiencing. But a real BIM revolution may still be forthcoming, as wider adoption enhances its full capabilities.

For more information on the value of BIM, the new SmartMarket Report is available for free download at www.analyticsstore.construction.com.

Post a comment to this article

Report Abusive Comment