The 21st-century gold rush doesn’t involve picks, shovels or pans. Instead, the rush to mine Bitcoin requires specialized computers that cumulatively use enough electricity to power Ireland or Austria, according to one estimate. Low-cost power is critical to the success of a Bitcoin mining operation, so miners scour the world to find cheap power to create the cryptocurrency.

The data center construction market, of which Bitcoin mining operations are a subset, is expected to book a compound annual growth rate of 9% in the U.S. and 11.2% worldwide between 2020 and 2025—reaching $34.5 billion, up from $22.6 billion in 2019, according to Research and Markets.

Right now, China, with its cheap coal and abundant wind power, leads the world for Bitcoin mining. Russia and the U.S. are tied for second place. The Pacific Northwest and upstate New York are favored American mining sites.

Bitcoin is the most popular cryptocurrency, a form of exchange with no central issuing authority. Digital currencies like Bitcoin exist online only—distributed across computer networks, much like other information on the internet. Instead of a central bank, cryptocurrencies are governed by an algorithm that compiles and tracks digital transactions (see more detail at bottom).

One of the newest U.S. mining operations is at the Greenidge generating plant in Dresden, N.Y. The 106-MW plant produced power by burning coal from 1937 to until 2011.

Private equity firm Atlas Holdings LLC bought the plant in 2014, and in 2018, began exploring opportunities for blockchain mining and data hosting. Atlas reached out to O’Connell Electric Co., which had done previous work at Dresden. “Our diversification put us in a good position,” as did the company’s ability to tap a deep pool of skilled workers, says Victor E. Salerno, the electrical contractor's CEO.

O’Connell Electric originally helped with a $65-million project to convert the Greenidge plant to burn gas. That project evolved into investing in the electrical infrastructure to support Bitcoin mining rigs—banks of specialized computers used to perform complex mathematical equations to process digital currencies, such as Bitcoin and ethereum. Over time, the equations grow more difficult, requiring more computing power.

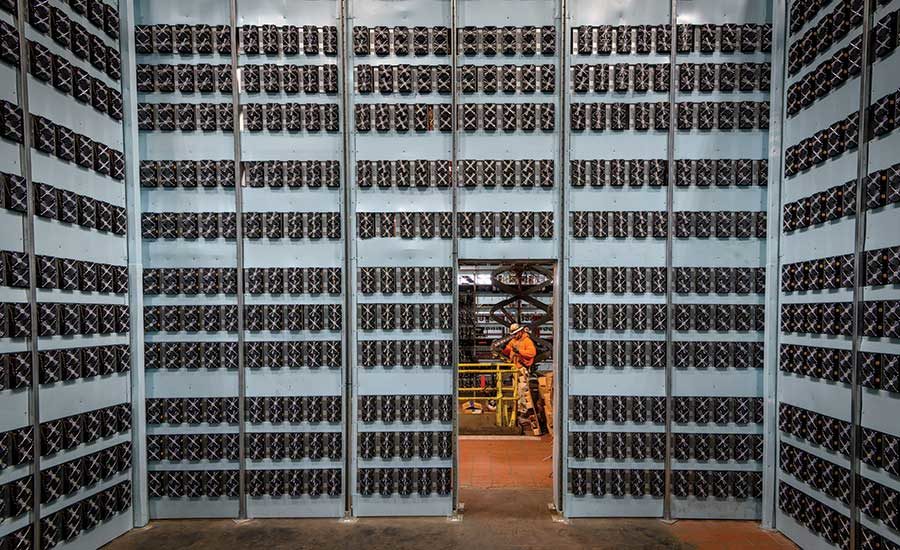

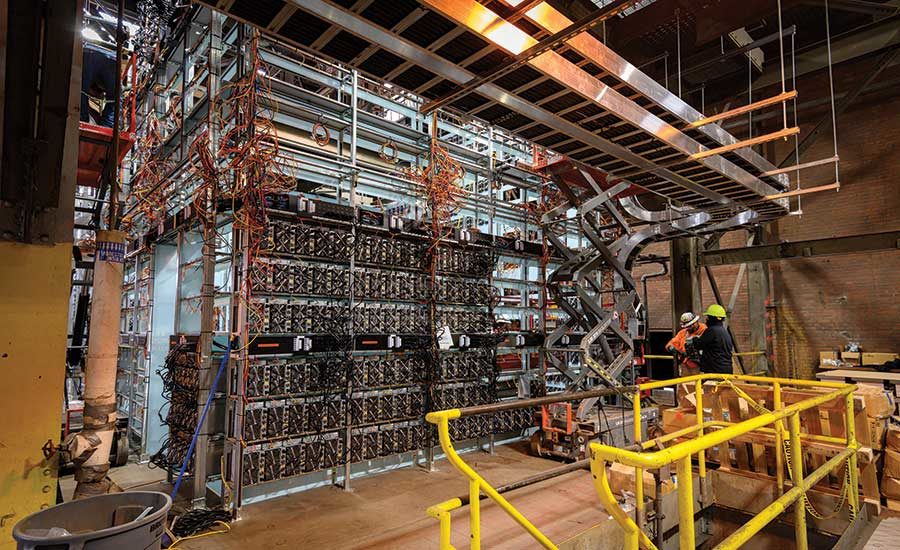

Atlas purchased about 7,000 mining rigs for the Dresden plant for about $2,000 each. To install the rigs, O’Connell drew on workers from four different groups within the company—power, construction, construction services, and communications—a workforce that included nearly 40 union members from the International Brotherhood of Electrical Workers.

The original plan was to install mining rigs in customized cargo containers outside the generating plant, but after three units were installed, the owners realized the noise far exceeded permitted decibel levels. Instead, the O’Connell team would need to fit all the needed gear inside the existing footprint of the power plant, running from one of its staggered levels and connecting to the distribution center 250 ft away on another level.

3D Modeling Prevents Clashes

O’Connell used a 3D scanner to create a model of the site with 1.5 billion measurement points. The design team then converted the equipment specs into 3D models and combined the data to create detailed drawings for the installation and to create a complete list of materials. The models also helped identify possible installation clashes, which were addressed on the plan, as opposed to being discovered on site.

O’Connell’s construction services group made a separate visit to the site to discuss plans for the raceway from the distribution center to the seven 3,000-kVA, 415/240-V mini-substations that provide power to the miners. The team took more scans and turned around a new installation plan, including another custom enclosure and list of materials, by the next day. In all, it took O’Connell four months to install and have the miners ready earlier this year. The contract value for the firm was roughly $10 million.

Atlas and Greenidge are now eager to expand their cryptocurrency mining operations. That means more work for O’Connell, which has begun a second phase installing 22 new 400-amp panels to power another 950 miners housed in the former coal-handling building of the plant. When completed, the mining operations will use 21 MW of the plant’s 106-MW capacity. “They have a lot of ideas, but they also change frequently,” says Richard Maher, O’Connell’s project manager.

The Bitcoin Boom

Cryptocurrency mining is a risky and volatile business. In 2017, Bitcoin prices zoomed from $900 per coin to $20,000, but days later fell 30%—ultimately falling 73% in 2018. The next year, Bitcoin prices doubled and continued to rise into 2020. As of press time in November, a single bitcoin was worth about $17,670.

When prices rise, mining operations proliferate. When the price falls, a mining operation is at risk of going out of business or is at least faced with making a quick change to its business model. The first cryptocurrency mining project O’Connell worked on, in Massena, N.Y. near the Canada border, is owned by Coinmint. It is housed in a former Alcoa aluminum factory, and its 435-MW transformer is powered by low-cost hydropower.

The proliferation of cryptocurrency mining in upstate New York prompted the local utility in Plattsburgh to declare a moratorium on mining operations because the high demand for electricity from Bitcoin mining raised electricity prices for ordinary customers. Cryptocurrency mining in Washington state followed a similar pattern.

The recent run-up in Bitcoin prices has, again, brought miners out of the woodwork. Last November, Whinstone US, a subsidiary of Northern Data AG of Germany, broke ground at a shuttered Alcoa aluminum factory in the small Texas town of Rockdale, which will be used as both a data center and for Bitcoin mining.

Construction on the project is still ongoing, even though the center began operation in the first half of this year. The Rockdale facility can offer a variety of high-level computing services, from consulting to data processing and Bitcoin mining, says Hans Durr, spokesman for Northern Data. In its first stage the facility is expected to reach a capacity of 1 MW, he adds.

The data center construction boom has also been good for its mercurial cousin, Bitcoin mining. While a boom can be a good business opportunity, and O’Connell’s Salerno says he is happy for the Bitcoin mining jobs when they pop up, it is not a niche the company is actively pursuing.

What Is Bitcoin, and How Is It Mined?

Bitcoin is the most recognizable and popular cryptocurrency, and it is mined, or discovered, in the same way as other digital currencies such as Ethereum or Litecoin, although there are variations in the mining process.

A defining characteristic of a cryptocurrency is that it is not fiat money, meaning there is no central issuing authority.

Digital currencies exist only as a series of ones and zeroes and are distributed across computer networks, much like other information on the internet. Cryptocurrencies are governed by an algorithm that compiles and tracks digital transactions. The transactions are assembled in inalterable blocks that are linked together to form the blockchain, which is the underlying, enabling technology behind all cryptocurrencies.

The series of networked computers on which cryptocurrencies live are known as nodes. The nodes store and disseminate the transaction blocks. Some nodes on the network are also miners: specialized computers designed to perform a phenomenal number of calculations. The speed of those computers is indicated by their hashrate, which is measured in trillions or even quadrillions of hashes per second. The higher the hashrate and the more calculations needed to mine a digital currency, the more secure it is.

Inside a digital currency miner, a high-speed computer is trying to guess a random number generated by the cryptocurrency system that, when combined with data in a pending transaction and passed through a hash function, converts input data of any size to output data of a fixed length, like fitting a key into a lock.

Solving the equation verifies the transaction and adds that block to the chain. The first miner to solve the equation is rewarded in cryptocurrency. The more equations a miner can solve, the more money that miner can earn. If it were that simple, however, huge banks of computers might be able to corner the market. So creators of digital currencies built another level of complexity into their governing algorithms by regularly raising the difficulty level of the equations needed to add a block to the chain.

For Bitcoin, it takes 10 minutes on average to process a block because that is the pace the developers of the currency determined is necessary to reach the cap they placed on the total number of bitcoins that will ever be created, 21 million, which is expected to be reached some time in 2140. There are currently about 18.5 million bitcoins in circulation.

Post a comment to this article

Report Abusive Comment