As European offshore wind power development accelerates, a series of costly failures has undermined confidence in turbine tower foundations. Now, a leading risk management company has produced new design guidance in a bid to prevent tower settlement that can cause potentially costly stresses in support structures.

Norway’s Det Norske Veritas A/S, H�vik, began reviewing its seemingly faulty design guidance in the fall of 2009 following reports of support failures in some completed turbine installations. DNV set up a study team with experts drawn from 11 utilities, engineering firms, suppliers and contractors to come up with the new guide.

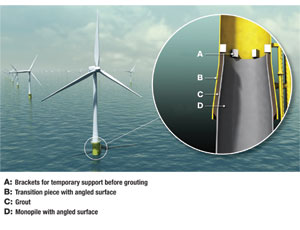

The foundations problem has led to complications on an undiclosed number of turbines supported by single, large-diameter steel columns. Known as monopiles, the foundations are driven deep into seabeds and extend to water surfaces. So far used in water under 20 meters deep, these monopiles can measure 70 m long and 5 m dia. A sleeve-like transition piece (TP), usually painted yellow, fits over the monopile to provide a platform well above the water to support the tower and turbine.

During installation, TPs are first held in place temporarily by internal steelwork brackets resting atop the monopiles. For final fixing, the TPs are jacked up, leaving a gap of a few centimeters between the brackets and monopiles. Permanent connections are made by grouting the void between the overlapping, concentric sections of TP and monopile. Finally, the jacks are removed.

However, in some cases, the grouted connections failed, allowing the TPs to settle. In those cases, the weight of tower and turbine was transferred to the temporary brackets, which were not designed for that purpose. The phenomenon led to concern about fatigue cracking in the structures, notes DNV’s report. No industry-wide figures of the scale of failures are available. DNV, the trade body Renewables U.K., London, nor Belgium-based European Wind Energy Association (EWEA), Brussels, provide data on the extent of grout failures.

DNV’s study team attributes grout failures to a combination of factors. They include distortion in the large-diameter pieces of steel and lack of tolerance controls. Sliding contact between surfaces under large wave- and wind-induced bending moments also damage the grout bond, it adds. To avoid such risks, DNV now recommends abandoning the traditional use of cylindrical overlapping sections between TPs and monopiles. Instead, it advises the use of slightly conical sections. Should a TP settle, it will make compressive contact with the grout to augment its remaining frictional resistance, the report explains.

Where cylindrical connections are already in place, additional supports should be considered to transfer axial loads, advises DNV. In additon, “such mitigation methods have been developed and are already implemented on several structures.”

With no chance of remodeling monopiles at completed installations, retrofitting mitigation measures at sea is likely to be costly. Monopiles supported two thirds of the 1,136 grid-connected turbines serving nine countries in Europe by the end of last year, according to EWEA data. Pre-emptive work to avoid potential problems on just one U.K. project, Sheringham Shoals, cost roughly $16 million, estimates Rune R�nvik, the developer’s project director. Sheringham’s 90 monopiles are 50 to 55 m long, 4.2-5.2 m dia and weigh up to 600 tonnes each, adds R�nvik. Made by Netherlands-based Sif Group b.v., Roermond, the monopiles started being placed last summer in the 317 MW field, that will extend 17-22 km off the Norfolk coast.

The Sheringham project side stepped the problems by changing the connection design while the steelwork was still in fabrication, says R�nvik. The developer, Scira Offshore Energy Ltd. is an equal joint venture of Norway’s Statoil A.S., Stavanger and Statkraft A/S., Oslo.

The first 630 MW phase of the London Array development in the Thames Estuary was able to make use of early drafts of DNV’s new guidance and adopted the conical connections. Offshore work for the 175 turbines is now about to begin in the Thames Estuary.

London Array’s 70-m-long, 5-m-dia monopiles and TPs, with a combined weight of 45,000 tonnes, are being delivered by the permanent joint venture of Denmark’s Bladt Industries A/S, Aalborg, and Erndtebrucker Eisenwerk GmbH & Co. KG (EEW), Rostock, Germany.

The same team last month secured a $330-million U.K. contract to supply monopiles and TPs for the U.K.’s 576 MW Gwynt y M�r wind farm, 13 km off the North Wales coast. Germany’s RWE Innogy GmbH., Essen; Stadtwerke München, Munich, and Siemens A.G, Erlangen own the roughly $2.7-million project. Monopile installation is due to start in 12 m to 28 m of water late this year and last nearly two years.

Wind Over the Horizon

Despite foundation difficulties, European offshore wind power is still in full sail. More than 300 turbines, with a combined capacity of 883 MW and cost of around $3.5 million were connected to European national grids in 2010, according to EWEA.

In September, Vattenfall Vindkraft A/S., Copenhagen, inaugurated the world’s largest offshore, fully operational windfarm, 12 km from the U.K.’s coast. The 300-MW Thanet windfarm includes 100 monopiles up to 60 m long and 4.9 m dia piles, which were supplied by Sif Group. Netherlands-based Smulders Foundations B.V., Helmonf, made the TPs, each weighing up to 210 tonnes.

Thanet’s size record will be overtaken by the 500-MW Greater Gabbard project further up the coast. All 140-m monopiles and over half the turbines have been placed for the farm 25 km off the Suffolk coast. Electricity was generated for the first time last month at the project site, which is valued at $1 billion, not counting grid connections.

Owned by Scottish and Southern Energy plc. Edinburgh, and RWE npower renewables Ltd., Swindon, the project appears to have recovered time lost when inspectors found faulty welds in early batches of monopiles.

The project is still due for completion next year, says an SSE spokesman. But it will lose its size record soon after when London Array starts sending 630 MW of power to a new substation now nearing completion on the north Kent coast.

Post a comment to this article

Report Abusive Comment