China has installed the first major offshore wind farm outside of Europe.

Located in the East China Sea, near Shanghai, the 102-MW Donghai Bridge Wind Farm began transmitting power to the national grid in July. The farm, which is slated to expand in the coming years, eventually will generate annually 267 million kilowatt-hours of electricity—enough to power 200,000 Shanghai households. It currently is supplying power to the Shanghai Expo and serving as a showcase project at the five-month-long international event.

The $337-million Donghai Bridge farm signals a new direction for Chinese renewable-energy projects and the initiation of a national policy focusing on offshore wind power. China’s first full-size farm is “quite significant,” says Rachel Enslow, wind consultant and co-author of the report “China, Norway and Offshore Wind Development,” published in March by Azure International for the World Wildlife Federation Norway. “Especially now, with the Shanghai Expo, it serves as a showcase of what the Chinese can do offshore.”

All of Donghai Bridge’s 34 turbines, 3 MW capacity each, were built by Sinovel Wind Group, China’s largest wind turbine manufacturer, and designed in cooperation with American Superconductor. The farm, located eight to 13 kilometers from the coast, was erected on soft seabed conditions using a multipile foundation structure, with eight to 10 legs placed on concrete piles, on top of which are stacked a concrete tack and then the turbines. Shanghai Investigation and Design Institute developed the foundation.

Construction Challenges

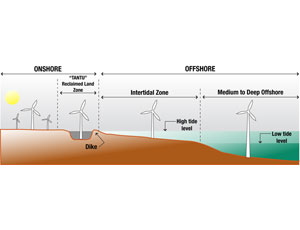

Indeed, one of the major challenges in China’s wind-power-generation expansion is the creation of foundations for the soft intertidal seabed. Unlike Europe, where turbines often sit 50 to 100 kilometers from the coast, “most offshore wind farms that will be developed in China will be intertidal,” explains Gerald Page, managing director of Equinox Energy Partners, a venture capital firm in Beijing. Intertidal turbine foundations are exposed during low tide and become submerged in about 5 meters of water during high tide.

Neither monopile nor jacket foundations—which often are used in medium- and deep-offshore sites in Europe—can be used in China because the seabed beyond China’s intertidal zone is “made of soapy, soft material,” explains Enslow. Installation of the turbines also will prove difficult, as large boats and equipment can’t operate in shallow water—and the intertidal area in China is usually less than 15 m deep.

Despite these obstacles, China was determined to move forward. “China wanted to show, ‘Hey, we can do this, too,’ ” says Enslow. Beijing-based Sinovel began building the farm in September 2008; CCCC Third Harbor Engineering Co. Ltd., also based in Beijing, installed the turbines, completing construction in February 2010. Shanghai’s Zhongtian Technologies Submarine Optic Fiber Cable Co. Ltd. manufactured the 78 km of submarine cable.

China’s government claims that, annually, the farm will cut use of 100,000 tons of coal, reducing carbon emissions by 246,058 tons. Presently, the farm’s capacity is equivalent to only 1% of the city’s total power production of around 18,200 MW, which is generated mostly from traditional fuel-based sources, says China Daily, the state-run English-language daily newspaper in Beijing. Construction of the Donghai project’s second phase, located on the west side of the bridge, has been approved by authorities. It, too, is projected to produce about 100 MW.

Charging Ahead

What the U.S. doesn’t realize, says Peggy Liu, founder and chairwoman of the Joint U.S.-China Collaboration on Clean Energy, is that China “is going from manufacturing hub to the clean-tech laboratory of the world.” Several offshore wind-farm projects are proposed in the U.S., including one off the coast of Cape Cod, Mass., and one off Block Island, R.I., but they are moving slowly due to state congressional debates and environmental concerns.

Meanwhile, the Chinese offshore wind industry is poised and ready to move forward with a cumulative pipeline of 13.723 GW in place, according to the “Development Plan on Emerging Energies,” a government plan announced on July 20 that outlines wind production goals through 2020.

As of March 2010, pipelines accommodating 17 MW were already installed between Donghai and a pilot wind project in Bohai Bay, near Tianjin; in total, 514 MW should be installed along China’s coastline—including the Liaoning, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian and Guangdong provinces—in the next three to four years, according to the Azure-WWF report. The cumulative pipeline is already half way to the estimated 2020 goal of 30 GW, and, in April, provinces were required to start drafting offshore wind-grid implementation plans.

| VALUE | |

|---|---|

| Rated output (MW) | 3 |

| Rotor diameter (m) | 91.3 |

| Swept area (m2) | 6547 |

| Rated rotational speed (rpm) | 7.5-17.6 |

| Cut-in wind speed (m/s) | 3.5 |

| Cut-out wind speed (m/s) | 25 |

| Hub height of the wind turbines from sea level (m) | 90 |

| Rated voltage (V) | 690 |

| Source: AZURE INTERNATIONAL | |

| Cumulative pipeline (MW) | |

|---|---|

| China National Offshore Oil Corp (CNOOC) | 3,102 |

| Longyuan Power Group | 2,465 |

| China Three Gorges Project Corporation | 2,010 |

| Huaneng (China) group (CHNG) | 1,302 |

| Guangdong Baolihua New Energy | 1,250 |

| Guodian Group | 800 |

| Shenhua Group Limited Liability Company | 500 |

| Datang Corporation | 329 |

| Changdao Wind Power Development Company | 300 |

| Shandong Sanrong Group | 300 |

| Zhejiang Lvneng Co Ltd. | 196 |

| Source: Azure International | |

Post a comment to this article

Report Abusive Comment