The $100-billion Asian Infrastructure and Investment Bank opened on Jan. 16 with the promise of promoting many more infrastructure projects than existing multilateral lenders such as the World Bank are capable of handling.

Three issues make the China sponsored bank unique: It is the first multinational development bank in which the United States has no role. It is also the first time that U.S. allies like the U.K., Germany and South Korea have defied Washington’s express wishes to join a financial institution.

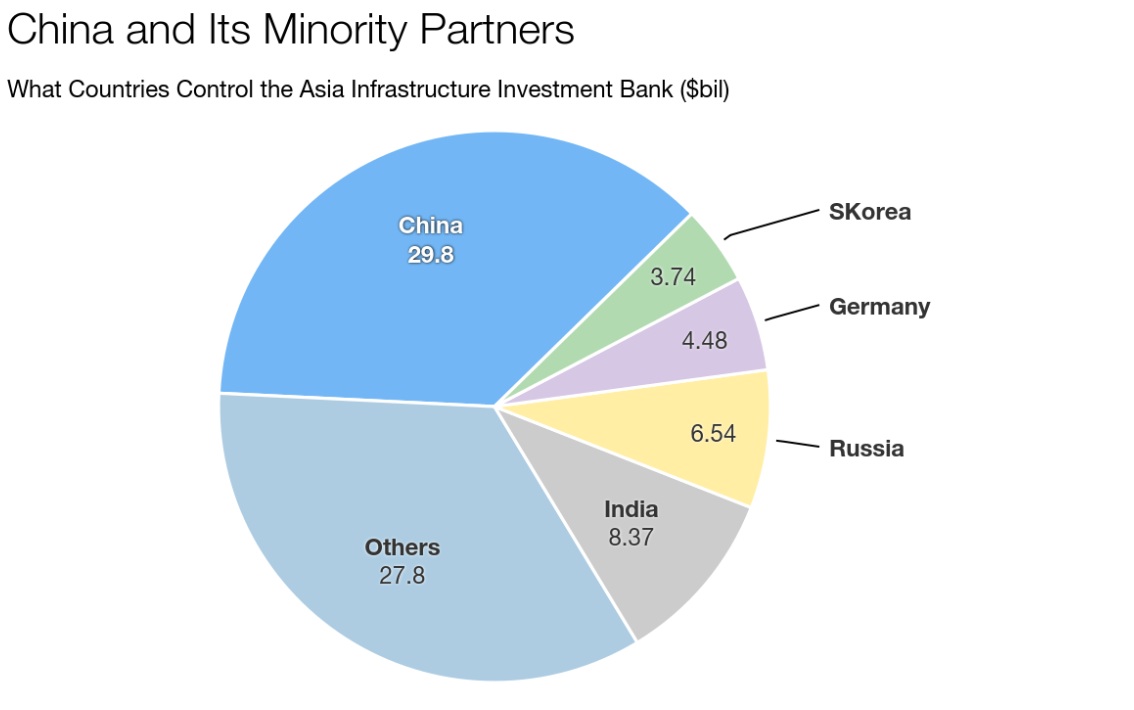

Some observers feel AIIB’s financing of Asian projects would open up huge opportunities for Chinese construction companies. China has 30% of the shares, by far the largest stake, and the bank is based in Beijing. Besides, its first president is a Chinese national (text continues below graphic/use scroll bars if needed).

More importantly, contractors from other Asian countries may not be able to match their Chinese counterparts in terms of pricing. Companies from the U.S. and Japan may be at a disadvantage because these countries are not members, analysts said.

But European countries, who have joined as members, are looking for their pieces of action. The City of London Corporation, the municipal body that controls the British capital, has already thrown its hat in the ring telling AIIB members that it has the necessary expertise to handle high-quality construction and design projects. European countries are looking for projects for non-renewal energy and environmental safeguards, observers said.

AIIB President Jin Liqun pointed to two other dimensions immediately after the bank was opened. Unlike the World Bank and ADB, the new bank will lend on “near commercial” terms without resorting to the practice of soft loans. Besides, it was ready to participate in joint lending with private commercial banks.

More Funding Available

What emerges from Jin’s initial pronouncements is that there will be more funding available but it would come at a higher pricetag.

Jin also talked about burrowing funds from the market in different currencies including the Euro and the Yuan. Such borrowings may push up the price of capital and ultimately the AIIB’s lending rate.

The top five shareholders in the AIIB are China, India, Russia, Germany and South Korea. At the World Bank, in contrast, the top five shareholders are the U.S., Japan, China, Germany and France. Though both institutions adhere to the principal of unbiased decision making, most analysts believe that shareholding matters.

“The IMF has generally acted as the head of a creditors' cartel that included the other "multilateral" lending institutions," said Mark Weisbrot, co-director of the Washington,D.C.-based Center for Economic and Policy Research." So the AIIB is a big break with a more than 70-year tradition of letting Washington call the shots in multilateral lending. Whatever governance system is chosen, Washington will not have a veto (in the AIIB)."

There is already a scramble for loans.

India, Sri Lanka, Indonesia and Nepal are among the countries who have proposed 3-4 projects each. An Indian official already went on record saying the AIIB will extend $1.2 billion worth of loans in the first year, and half of it will come to India. Jin has himself said that the first set of loans will be sanctioned in 2016. Analysts are asking if the competition for loans will create differences within the bank’s board in the initial stages when it is settling down to regular business.

One of the criticism leveled against the bank is that it would come under political pressure of Asian members, and waive the need for environmental checks before project approval. Jin countered the criticism saying that AIIB was formulating a set of very strict standards that would be, in some way, better than those of the World Bank and Asian Development Bank.

Environmental Checks Pledged

“We are finalizing our environment and social framework. The paper we have drawn up for ESF is as good as the other institutions, and in some respects better than them,” Jin said.

AIIB will have a strong compliance and integrity department to make sure there are no irregularities in the approval of loans, he said.

“The bank management will be very careful. It will put the last cent to use,” Jin said.

Some analysts had speculated that the new bank would try to promote the Chinese yuan as an international currency. But AIIB seems to be in no mood to take chances. It will lend in the US dollar like other international institutions but raise funds in different currencies.

Post a comment to this article

Report Abusive Comment