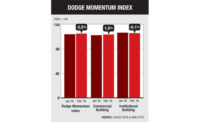

The Dodge Momentum Index erased the gains made over the last two months, falling 4.4% in July to 121.4 (2000=100). This marks the index’s first decline in four months, according to McGraw Hill Construction, a division of McGraw Hill Financial.

The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

While the Dodge Momentum Index stumbled in July, on a year-over-year basis it remains 16.5% higher than a year earlier. The July decline therefore may simply be a return to a more sustainable pace following a spring bump.

July’s decline in the Momentum Index was the result of a 6.8% drop in commercial building plans while the institutional sector fell a milder 0.6%. Despite the drop, six sizeable commercial projects valued at $100 million or more entered planning in July.

Those include the $400-million 50 Hudson Yards Office Tower in New York City, the $350-million University Town Center (Phase II) in Sarasota Fla., the $319-million Consolidated Rental Car Facility at Tampa International Airport, the $130-million Irvine Center Office Tower in Irvine, Calif., a $100-million hotel in Brooklyn, N.Y., and the $100-million Akard Place Office Tower in Dallas.

Post a comment to this article

Report Abusive Comment