Maybe it is the gains on Wall Street. Maybe it is the recent midterm elections. Maybe it is the general optimism of the construction industry at work. Whatever the reason, major contractors, design firms and subcontractors are feeling decidedly less pessimistic about construction market prospects than they did just three months ago, according to the ENR Construction Industry Confidence Index survey for the fourth quarter of 2010.

The ENR Construction Industry Confidence Index (CICI) for the fourth quarter of 2010 spiked to 43 on a scale of 100 from 32 in the third quarter. An index of 50 would mean a stable market. The 756 executives of large construction and design firms responding to the survey believe that the market is moving out of free fall and may soon be stable.

The CICI measures executives sentiment about the current market and projections for where it will be in the next three to six months and over a 12- to 18-month period. The index is based on responses to surveys sent to more than 3,000 U.S. firms on ENR’s lists of the leading contractors, subcontractors and design firms. The current index is based on a survey conducted from Nov. 23 to Dec. 13.

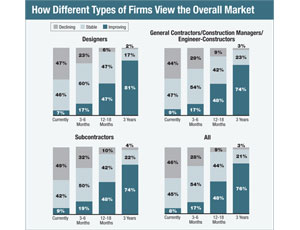

This quarter, 46% of all respondents say the market is still in decline, down from 63% in last quarter’s survey. Design firms continue to be more optimistic about a turnaround in the near term than general contractors or subcontractors (see chart, p. 55).

Applying the CICI formula to individual market sectors, respondents felt more optimistic in all markets except for transportation, which remained unchanged at a level of 50. Markets in which respondents see growth either currently or in the near future include health care, rated at 66 on the CICI scale, higher education (55), petroleum (59), power (67), water/sewer/waste (57), and hazardous waste (56).

Another survey that sees an increase in industry optimism is the most recent CONFINDEX survey, which is about to be released by the Construction Financial Management Association, Princeton, N.J. CFMA polls 200 chief financial officers from general contractors, subcontractors and heavy and civil contractors. “Our CONFINDEX went from 106 to 117 in the fourth quarter,” says Brian Summers, CFMA chief operating officer.

Timing Is Everything

Like ENR’s CICI, CFMA’s CONFINDEX dropped in the third quarter, only to rebound strongly in the fourth quarter. “Part of this drop may have been the timing of the survey responses,” says Summers. He notes that both the CICI and CONFINDEX surveys were collected in late August, during a plunge in stock prices and concerns over economic fundamentals, which may account for both indexes’ plunge last quarter. “Wall Street in not a reflection of the construction market, but falling stock prices have a psychological effect on people,” he says.

The CONFINDEX is broken down into four indices. The strongest rise in optimism concerned business conditions, which surged from to 129 from 110 on a scale of 200, indicating the belief that the market is ready for a turnaround. However, the survey’s “financial-conditions” index inched up to 105 from 101. The results suggest industry CFOs believe financing may still be a problem in 2011.

CICI survey respondents are also worried about project financing. ENR once again asked about client access to capital for project financing. In the fourth quarter, 34.5% of respondents said the credit markets continued to tighten for construction projects over the past six months, while 51.2% said the availability of credit was unchanged during that period. While still troubling, these figures are an improvement over the last quarter when 45.2% respondents said the credit market was continuing to tighten.

Post-Election Hangover

The CICI survey also asked industry executives about the potential impact of the congressional midterm elections. Of the 756 respondents, 401 (53.0%) thought the election would be good for the overall economy, while 64 (8.5%) said it would be bad, and 160 (21.2%) did not believe it would have any impact. When asked about the election’s impact on the construction industry, 40.5% said the industry would benefit, while 12.2% said the impact would be bad; 26.5% said it would have no impact.

The favorable response to the mid-term elections may have buoyed industry confidence a bit. However, the election may be a double-edged sword. “There are many in the industry who believe that gridlock in Washington [with the Republicans now a majority in the House] is a good thing, but gridlock may hurt companies in the infrastructure sector that are hoping for additional federal funds for sectors like transportation, water and sewer work,” says Anirban Basu, CEO of Baltimore-based economic consultant Sage Policy Group Inc. and an economic advisor to CFMA. He says partisan politics may further stall bills such as the federal transportation reauthorization bill.

Many CICI participants continue to worry about inflation. In this quarter, 52.1% of respondents said they had seen upward price pressure in at least some materials or equipment. Copper and steel were the most frequently mentioned items experiencing price increases, along with concrete, drywall, fuel and petroleum-based products.

“These findings are consistent with the November [Producer Price Index] report,” which rose by 0.8%, says Basu. He says that, while materials prices have been creeping up recently, there continues to be heavy competition for work, leading to a further squeeze on profit margins.

Summers notes that there is another element for construction firms to consider: staff salaries. “Many top staff people, including CFOs, have gone without raises for two years or more. Now that the market is beginning to brighten a little, they will expect increases.”

Post a comment to this article

Report Abusive Comment