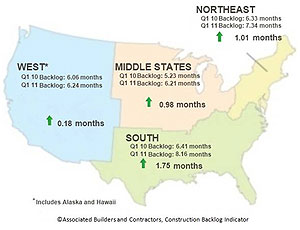

Associated Builders and Contractors reports that its Construction Backlog Indicator (CBI) for the first quarter of 2011 averaged 7.3 months, a 4% increase from 7.1 months during the fourth quarter of 2010, and up from 6.1 months, or an increase of 21%, from one year ago.

According to ABC, CBI is a forward-looking indicator that measures the amount of construction work under contract to be completed in the future.

“If construction materials prices are better behaved going forward, the recovery in commercial and heavy industrial construction may accelerate,” says Anirban Basu, ABC’s chief economist. “However, infrastructure-related construction is largely dependent upon government budgetary decisions and for now the focus remains largely upon government cost-cutting as opposed to accelerating investment.”

Basu adds that while the commercial and industrial construction industry is no longer in deep decline, meaningful recovery “remains elusive, with CBI still below levels associated with vigorous nonresidential construction activity.

“However, crisis conditions have abated and the indicator is moving in the right direction. CBI is now 33% above its historic low point of 5.5 months registered in January 2010.”

During the first quarter of 2011, backlog rose for all categories of firm size.

As has been the case for many quarters, the larger the firm, the larger the average backlog, Basu says.

Average backlog for the smallest firms, those with revenues below $30 million per annum, now stands at 6.4 months, the highest quarterly reading on record.

“Backlog for firms in the second smallest category, those with revenues between $30 million and $50 million per annum, is roughly unchanged from year-ago levels, suggesting that for many contractors the recovery is far from vigorous,” says Basu. “Interestingly, backlog continues to rise for the largest firms on average despite the gradually diminished impact of federal stimulus spending.”

Post a comment to this article

Report Abusive Comment