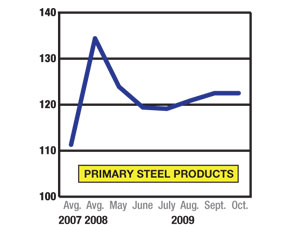

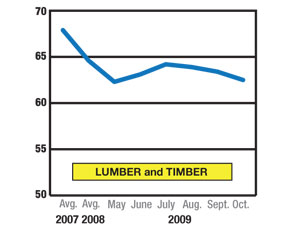

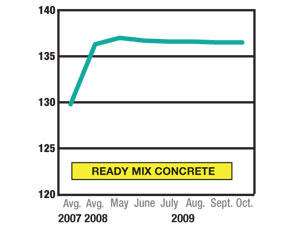

In light of Canada’s cooling construction market, materials costs have stabilized after years of price spikes, but they are stabilizing at high levels.

Costs generally are remaining at historically high levels, says Scott Beattie, senior cost consultant at Marshall & Murray, London, Ontario. “In looking at school projects, for example, square-footage costs are still coming in higher than two or three years ago,” he says. “It is the same in health-care work.”

Labor costs also have remained stable, particularly in heavily unionized areas, Beattie says. Still, there is concern that a government economic-stimulus package could push up labor costs further. Stimulus projects have been announced, but few have hit the streets. “If they all come out at the same time, there could be some labor and materials shortages,” he says.

According to Beattie, some owners already are reacting. For example, one “switched from a steel structure to a concrete structure,” he says. “Today, steel would be the best bet, but the client does not want to deal with shortages down the road,” he says. Some industry observers expect price hikes in Toronto due to infrastructure planned there for the 2015 Pan Am Games. This rise would be similar to what occurred in Vancouver, B.C., as it prepared for the 2010 Winter Olympic Games, which begin in February.

The global economic recession has hammered much of the developed world, but Canada has escaped the worst, thanks to the country’s stable banking sector. However, the weak U.S. economy, combined with a strong Canadian dollar, has lowered U.S. demand for Canadian products.

With lower exports pushing down the nation’s economy, Canadian GDP will decline 2.7% in 2009, predicts McGraw-Hill Construction Research & Analytics, like ENR, a unit of The McGraw-Hill Cos. The drag from weak exports will linger into 2010, resulting in GDP growth of just 2% next year, says Analytics. Low interest rates are expected in the next several quarters, which will support the housing sector. Analytics expects the sector to begin to rebound in early 2010 but says the value of housing permits will only grow 6% as house sizes shrink.

All told, Analytics expects Canadian construction permits to decline 24% in 2009 to $53.2 billion (Canadian). It says they will inch up 0.5% in 2010 as a rebounding residential market offsets sluggishness in the nonresidential sector. By 2011, the fiscal and monetary stimulus working through Canada’s economy will boost construction. Vancouver will lead the country’s recovery in 2010, but it may take another year for the other four major Canadian metro areas—Toronto, Montreal, Edmonton and Calgary—to follow suit, says Analytics.

Permits for commercial construction have suffered the most over the past two years, with the total value down to $13.3 billion in 2009, 21% lower than the 2007 peak. Analytics says they will fall again in 2010 but pick up speed along with the economy in 2011. Analytics also expects industrial permits to decline 25% in 2009, to $3.8 billion, but rebound by 3% in 2010. Even so, a strengthening Canadian dollar could keep permit growth more modest than expected.

Institutional construction was the one source of growth in 2009, fueled by stimulus and demographics. Analytics expects the value of permits to grow 12%, to $8.7 billion. It says permits in 2010 for education construction will become the largest for nonresidential buildings.

Post a comment to this article

Report Abusive Comment