Contractors are feeling the impact of the changing economy, but many are failing to prepare for what may not be just a normal recession, according to industry management consultant FMI Corp. in a new report.

In its survey conducted in February of 230 executives of U.S. construction firms in various revenue categories and market segments, Raleigh, N.C.-based FMI says respondents anticipate much uncertainty ahead. Three-quarters of respondents foresee workforce cuts, and 77% expect profits to drop. While 74% of firms have boosted business development in the last six months, only 56% are formally evaluating their capabilities and constraints and only half are reviewing customers and markets with any formality. The survey contends that midrange firms with annual revenue between $500 million and $1 billion “are anticipating the most uncertainty and are least prepared.”

FMI says direct responses from executives to the changing conditions ranged from “business as usual, hoping things will get better” to “intense visioning and strategy sessions to examine all products and services offered, cost position and customer requirements.”

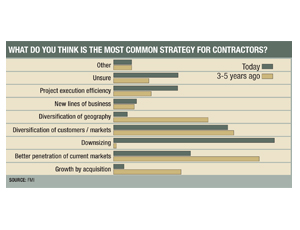

According to FMI, 84% of firms say competition has increased, with 80% citing lower pricing as their primary response. Only 30% have a “detailed understanding” of competitors’ strategies, and only 29% are actively assessing the competition. But the survey points to “subtle shifts” in contractor strategy today, with fewer firms adopting the “same game with better execution” approach and more seeking new customers and markets.

Except for firms with annual revenue over $1 billion, few were preparing for the impact of federal stimulus funds, believing that “government intervention will only replace lost demand, not stimulate a building boom,” the survey points out.

“Far too many contractors have yet to adapt to the changing context. As uncertainty increases, so too should the level of preparation and depth of analysis,” says survey author Briston Blair, head of FMI’s strategy practice. “There are many possible futures facing the industry, and those firms preparing and adapting now will be there to win big when the market recovers.”

Post a comment to this article

Report Abusive Comment