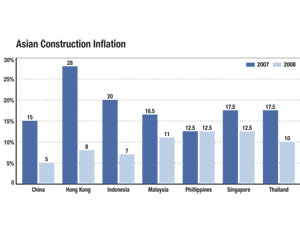

Uncertainty prevails in Asian construction markets this quarter as the global financial scare causes materials price indexes to go awry. A drop in building demand across China and Southeast Asia in the past two months has sparked a broad-based deflation of materials prices following record-high levels for steel, scrap, rebar, copper, and others, which peaked just months ago.

“It’s the confluence of shrinking demand and market uncertainty that is driving a drop in materials prices in Asia, particularly for steel and oil-derived products,” says Julian Anderson, president of Phoenix-based consultant Rider Levett Bucknall Inc. Producers in Thailand, Vietnam, Singapore, Malaysia, Indonesia and the Philippines are scrambling to renegotiate contracts or are seeking government aid to stop the bleeding.

Filipino scrap-metal prices have dropped nearly 60% since September due to shrinking global demand, says Aquino Dy, president of the Scrap Collectors and Recyclers Association of Philippines. It is a bitter pill for scrap dealers who were getting record-high prices for scrap steel and other metals last summer. Globally, “buyers have stopped importing and local steel mills aren’t producing because of the weak demand,” he says. Corazon Ballard, managing director at Manila consultant Rider Hunt Liacor Inc., adds, “developers are just watching to see what it will cost them if they continue building.”

Thailand’s materials prices have dropped in similar fashion, but lower costs offer little consolation in markets where real-estate experts expect few new projects in the next 24 months. Cement prices in Bangkok, however, have risen in the past month as falling demand thwarts producers’ need to achieve economy of scale in production, says Staporn Phettongkam, secretary-general of Siam City Cement Plc., Bangkok. Thai developers “need to find alternative lower cost materials,” he says.

In Singapore, construction costs have waned 10% overall since last quarter, says the Singapore Contractors Association. Since August, per-ton steel-bar prices decreased from about $1,140 to $740, with concurrent price drops for concrete and sand, and a 50% cut for crane rentals. Labor costs have not corrected yet, but a “tapering off” is expected by mid-2009, says Group President Desmond Hill.

Inflation in Vietnam has hovered around 20% for months, tempering in materials price decreases this quarter. Steel prices dropped by half from a record high of $1,313 per metric ton in July. The price of imported steel ingots fell from $950 per metric ton to $540 in November, according to Hanoi-based Vietnam Steel Association.

In China, however, there is still enough momentum in juggernaut building markets to generate opportunities and optimism amid the bargain-basement prices. “Chinese developers are still bullish in this market, because they tend to focus on low-cost solutions rather than on value-added solutions that western contractors aim for,” says Bill Gartz, principal at Seattle-based Callison, which is managing several Chinese projects. Still, “tender prices are falling universally and bidders are shortening margins,” says Peter Morris, principal at Sacramento-based cost consultant Davis Langdon & Seah.

Economic growth in China slowed to 9% in the third quarter, the lowest in five years, pushing price drops for commodities such as zinc, nickel, iron ore and aluminum. With so many scrap suppliers feeding China’s huge metals appetite, the slowdown has caused global havoc.

The Institute of Scrap Recycling Industries, Washington, D.C., complained to the Chinese last month about ordered U.S. scrap shipments being refused delivery at Chinese ports. It says Chinese brokers who placed orders months ago are balking as loads arrive amid depressed prices and markets. “They’re demanding we lower prices or forcing us to ship the materials back,” says Marc Kaplan, president of Mews Metal, Verona, N.J. “We have been a major supplier to China for years, but we had two orders shipped to Shanghai in December that the Chinese refused to accept.” Along with a shipment to India also refused, Kaplan says his firm faces a loss of about $2.9 million.

Post a comment to this article

Report Abusive Comment